Well, the market hasn’t even opened yet in the U.S. on Monday morning (and I say “morning” loosely, since my dogs know what’s going on with Greece and got me out of bed at 4:30, so it’s pitch black here in Palo Alto) and it feels like we should be getting the Friday bar ready, since there’s been so much amazing news over the past 72 hours. There were over 600 comments on my site this Sunday – – on a Sunday, people. Most blogs don’t get that many comments in a year.

One might think I’m disappointed the ES has pared its losses by half already. Nope. I actually prefer it (honest!) I am not aggressively short “the market” at all right now. Yes, I’ve got 80 individual shorts, but I have one and only one big short in the form of an ETF, and that is the high-yield instrument SPDR Barclays High Yield Bond (ARCA:JNK), which is kind of a throwaway. I’d be a lot more upset if I had a big options short, since the plunge of over 40 points on the ES at the opening bell was so exciting.

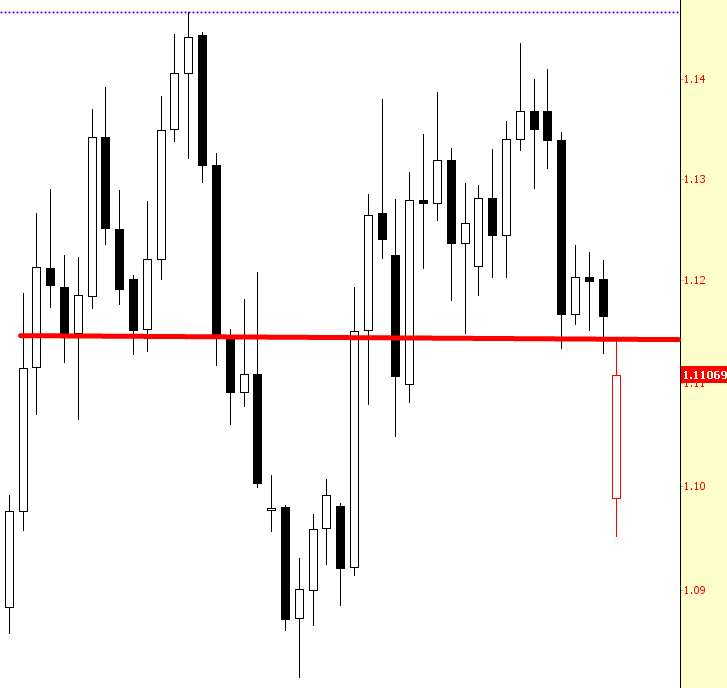

As it is now, there are two fascinating things going on. First, the EUR/USD has pretty much rallied all night, but only to an area of massive overhead supply. I wouldn’t be surprised to see it collapse from approximately these levels.

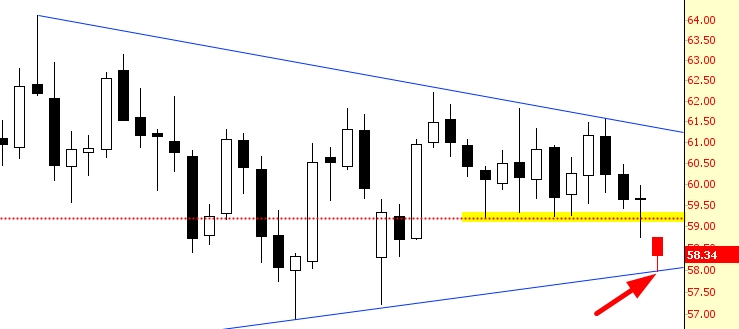

Second, crude oil is still firmly lower. Interestingly, the chart is “behaving” itself with incredible precision. After it broke support on Friday (tinted), it had marvelous follow through on the most recent section. Most interesting of all, it bottomed (for now, and I emphasize, for now) at precisely my lovingly-drawn trendline. This is what I mean when I say “charts are working again.”

I’d much rather start the week with a “controlled descent” than having the ES down, say, 50 points. Steady erosion beats a crash in my book, absolutely.