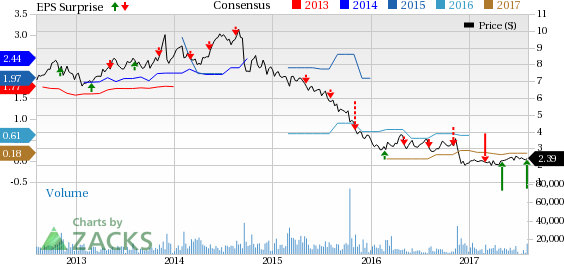

PDL BioPharma, Inc. (NASDAQ:PDLI) reported earnings of 26 cents per share in the second quarter of 2017, surpassing both the Zacks Consensus Estimate and the year-ago earnings of 9 cents per share.

The company generated total revenue of $143.8 million in the quarter, significantly skyrocketing 583% compared with the year-earlier figure of $21 million. This increase in revenue is mainly driven by royalties from PDL BioPharma’s licensees to the Queen et al. patents. Also, a rise in royalty rights — change in fair value — contributed to higher revenues this quarter. This was primarily due to the current period’s increase in fair value of the Depomed royalty asset.

Notably, the company received cash payments of $34.6 million from the royalty rights acquired from Depomed, primarily related to Glumetza, a product marketed by Valeant Pharmaceuticals International, Inc. (NYSE:VRX) . An authorized generic version of Glumetza was also launched by a Valeant subsidiary in February for which, PDL BioPharma receives 50% of the gross margin.

The company’s shares rallied more than 10% at after-hours trading on Monday. Shares of the company have outperformed the industry so far this year. The shares have climbed 12.7% compared with the industry’s increase of 8.9%.

Quarter in Detail

Revenues included royalties of $16.3 million from licenses to the Queen et al. patents, which consisted of royalties earned on sales of Tysabri, net royalty payments from the acquired royalty rights and a change in fair value of the royalty rights assets of 83.7 million, interest revenues of $5.5 million, product revenues of $18.2 million (sales of Noden products – Tekturna and Tekturna HCT in the U.S. and leasing of the LENSAR Laser System) and license and other revenues of $19.5 million.

Revenues of $16.2 million from the Queen et al. licenses were higher than the year-ago figure of $14.2 million, courtesy higher royalties on Tysabri from Biogen Inc. (NASDAQ:BIIB) .

Research and development (R&D) expense for the quarter came in at $4.2 million. No R&D costs were recorded in the year-ago quarter.

General and administrative expenses surged 61.4% to nearly $11.3 million from the year-ago figure.

Zacks Rank & Key Picks

PDL BioPharma currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the healthcare sector is Enzo Biochem, Inc. (NYSE:ENZ) , carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Enzo Biochem’s loss per share estimates narrowed down from 12 cents to 7 cents for 2017 and from 11 cents to 3 cents for 2018, over the last 60 days. The company delivered positive earnings surprises in all the trailing four quarters with an average beat of 55.83%. The company’s share price has surged 64.5% year to date.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

PDL BioPharma, Inc. (PDLI): Free Stock Analysis Report

Enzo Biochem, Inc. (ENZ): Free Stock Analysis Report

Biogen Inc. (BIIB): Free Stock Analysis Report

Valeant Pharmaceuticals International, Inc. (VRX): Free Stock Analysis Report

Original post

Zacks Investment Research