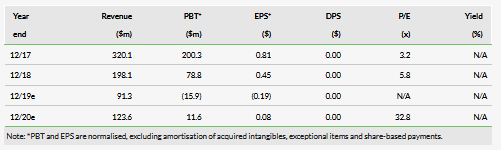

In June, PDL BioPharma Inc (NASDAQ:PDLI) invested the second and final tranche of $30m ($60m in total) in Evofem, a women’s health company that is preparing to submit an NDA for Amphora, a non-hormonal female contraceptive, in Q419 with approval expected in H120. PDL now owns approximately 29% of the company. Evofem recently released exploratory data from its pivotal AMPOWER trial, which indicated that unlike other contraceptives, Amphora may increase sexual satisfaction, which could give it a marketing edge upon approval. The market opportunity is quite large, with $6.5bn worth of hormonal contraceptives being sold in 2018 according to EvaluatePharma.

Amphora’s potential advantages

Evofem’s Amphora, unlike much of the competition, is non-hormonal and therefore does not have the same long-term safety concerns. It works by maintaining the vaginal pH level in the 3.5–4.5 range, which is mildly acidic and inhospitable to sperm. Amphora also has lubricant properties and based upon data from the pivotal AMPOWER trial, helped improve the sexual satisfaction of almost 50% of women in the trial.

LENSAR growing strongly

The LENSAR femtosecond cataract laser business had product revenue of $7.4m in the quarter, up 26% compared to Q218 and up 10% sequentially. Importantly, procedure volume also grew by 28% compared to the previous year. According to PDL, one of the reasons for this growth is that the company is not as financially constrained now that LENSAR is part of a bigger, well-funded entity.

AcelRx royalty write-down

PDL had previously acquired the rights (mainly for the EU) to Zalviso, an approved drug/device combination product that dispenses a sublingual formulation of sufentanil, from AcelRx for $65m. After royalties were not tracking in line with forecasts, an analysis by a third party was conducted and PDL decided to take a $60m write-down on the product.

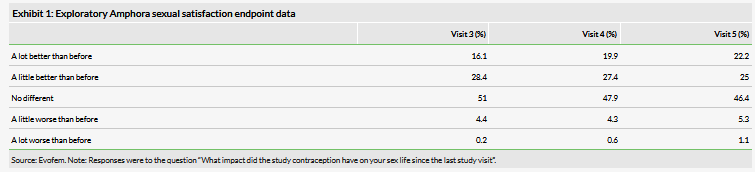

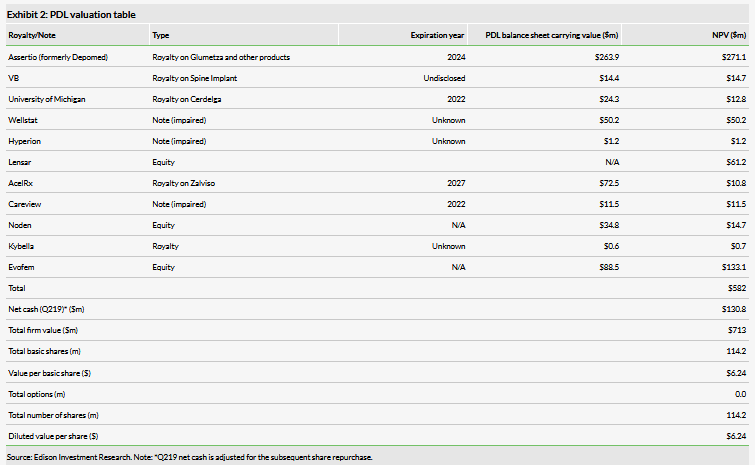

Valuation: $713m or $6.24 per share

We have decreased our valuation to $713m or $6.24 per basic share, from $789m or $6.54 per share, mainly due to lowering our valuation for the AcelRx royalties and a lower net cash level. This was mitigated by an increase in the value of the Evofem stake due to the higher investment, while the per-share PDL value was assisted by the stock buyback, which is now complete.

Business description

PDL BioPharma currently has a collection of healthcare-related royalty and note assets as well as Tekturna/Rasilez for hypertension and an equity stake in Evofem. PDL is seeking additional commercial-stage pharmaceutical assets with multiple-year revenue growth potential, as well as late clinical-stage pharmaceutical products.

Amphora update

Following the investment of the second tranche of $30m, PDL now owns 29% of Evofem. As a reminder, Evofem is developing Amphora as a contraceptive, a large addressable market. According to the CDC, 61.7% of the 60.9 million women aged 15–44 use contraception and 27.6% (around 16.8 million) use either short- or long-acting hormonal oral contraceptive pills or devices such as a ring or a patch. Amphora is bioadhesive vaginal gel that is a mix of L-lactic acid, citric acid and potassium bitartrate, all compounds that are considered to be generally regarded as safe (GRAS) by the FDA and are frequent ingredients in food. Amphora works by maintaining the vaginal pH level in the 3.5–4.5 range, which is mildly acidic and inhospitable to sperm, which requires a more neutral pH environment for optimum mobility. Typically, semen, with a pH of 7.2–8.0, helps to raise the pH of the vaginal environment to 6.0 or higher. Data indicate that Amphora is effective if applied up to 10 hours prior to intercourse.

In December 2018, Evofem announced the results of the AMPOWER trial. In that trial, Amphora met the primary endpoint with a seven-cycle cumulative pregnancy probability of 13.7% with the upper limit of the confidence interval at 17.4%. The company recently released additional data from the trial that indicated that Amphora, besides being an effective contraceptive, also appears to improve sexual satisfaction in almost 50% of participants (see Exhibit 1). At baseline, participants in the trial had been asked if their most recent contraceptive method had any impact on their sex life and only around 17% had indicated any improvement, indicating an opportunity for Amphora to provide a potential benefit. This data (though only exploratory and in an uncontrolled trial) plus Amphora’s lubricant qualities, may help provide it a marketing edge in a large, competitive market.

Q2 results

PDL reported Q219 revenues of negative $22.5m due to a $60m write-down of the AcelRx royalties related to Zalviso. PDL had acquired the royalty rights to Zalviso, a drug/device combination product that dispenses a sublingual formulation of sufentanil, from AcelRx for $65m in September 2015. AcelRx had partnered with Grunenthal in the EU, Switzerland and Australia, and so PDL acquired the right to 75% of the royalties received from Grunenthal (AcelRx is eligible for mid-teen to mid-20% royalties) and 80% of the first four commercial milestones.

Zalviso was approved in the EU in 2015 to treat moderate to severe post-operative pain in the hospital setting for up to 72 hours and is meant to be used instead of intravenous patient-controlled analgesia. After royalties were not tracking in line with PDL’s forecasts in prior quarters, the company enlisted the help of a third party to conduct an analysis, which concluded that the target market (patient controlled analgesia) was smaller than initially thought, the high price is limiting switching from alternative therapies and as the device is prefilled for three days of use, its use in procedures with shorter recovery times is limited. Following the write-down, the carrying value for the AcelRx royalties is now $12.5m on the PDL balance sheet. Absent the impact of the AcelRx write-down, revenues associated with the royalty business would have been $19.6m, up 52% compared to Q218, almost exclusively due to cash royalties related to the Assertio assets.

Noden net revenue was $10.4m in the quarter, down 60% compared to Q218, mainly due to the launch of a third-party generic in the United States in March of this year as well as due to inventory stocking of the authorized generic in Q119. As the US is the more profitable segment, gross margins fell from 55% to 29% between the first and second quarters. Noden showed a slight operating loss of $345,000 in the quarter and the company is targeting returning to profitability. The company ceased all promotional efforts in Q219 and restructured the Noden US team, which will lead to lower expenses in H219.

Additionally, LENSAR had product revenue of $7.4m in the quarter, up 26% compared to Q218 and up 10% sequentially with most of the growth attributed to the Asian market. Importantly, procedure volume also grew by 28% compared to the previous year. The quarterly loss for LENSAR was $1.7m, slightly lower than the $1.9m loss in the same quarter last year. Gross margin fell from 44% in Q1 to 34% in Q2 due to product mix as systems have lower margins than consumables.

Valuation

We have decreased our valuation to $713m or $6.24 per basic share from $789m or $6.54 per share. Due to the company re-rating the value of the AcelRx royalties, we have lowered our NPV estimate for them from $73.7m to $10.8m as we reduced our peak sales estimate from around $188m to $23m. The other significant valuation change was the increase in the value of the Evofem asset from $89.0m to $133.1m due to the higher stake owned by PDL. We also lowered the value of LENSAR by $0.4m as the positive impact of increasing revenues was superseded by lower margins. Additionally, we have lowered Noden by $1.0m mainly due to lower margins. Net cash also fell due to the second tranche of the Evofem investment ($30m) and the cost of the share repurchase program during the quarter ($26m). Note that following the end of the quarter, the company repurchased 1.3m shares for a total of $4.1m, which concludes the share repurchase program in which 31m shares were repurchased for a total of $100m.

Financials

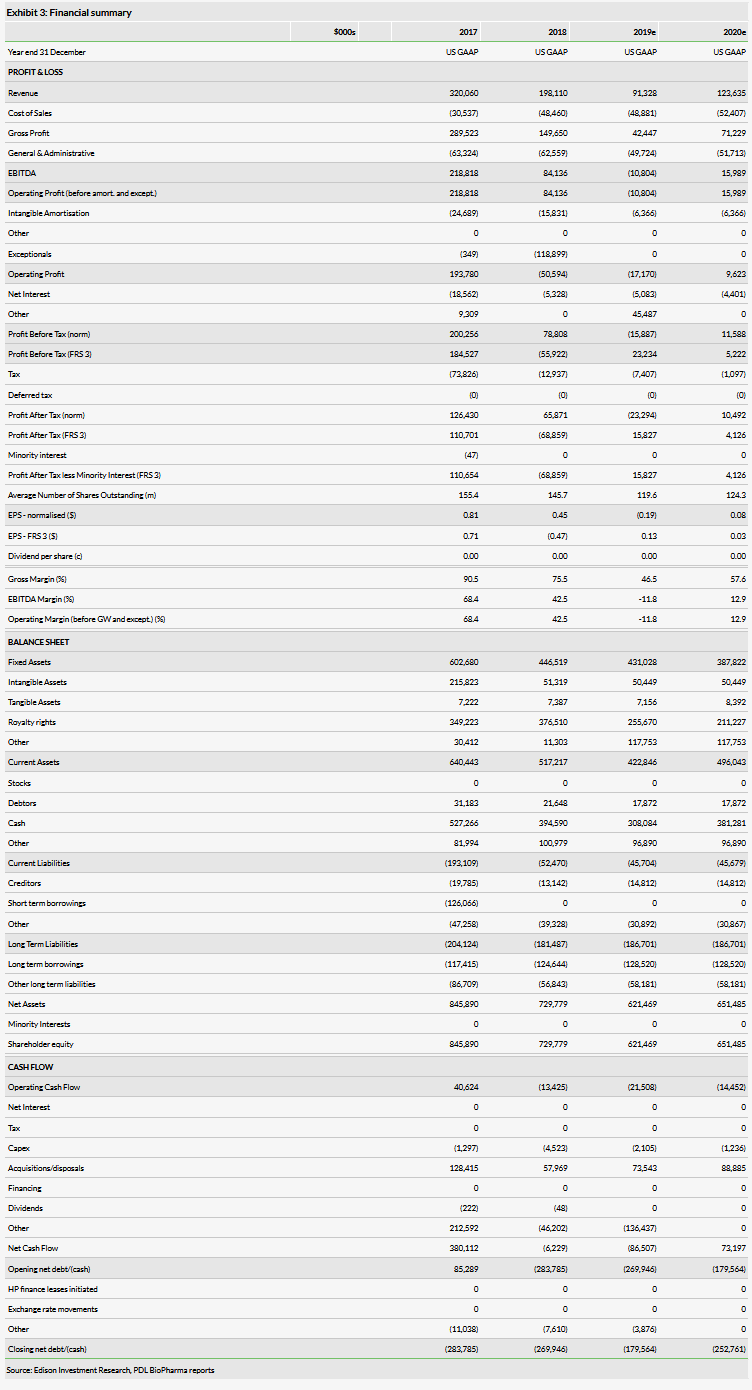

We have lowered our FY19 revenue estimate from $123.5m to $91.3m on account of the AcelRx write-down, which subtracted $60m from revenues. Otherwise, revenues are tracking higher than our initial estimates. Our FY20 revenue estimate is lower by $2.1m mainly due to the elimination of the bulk of expected AcelRx revenues, which were mitigated by higher LENSAR estimates. We have increased our COGS estimates by $17.3m for 2019 and $22.6m for 2020 as we are now assuming lower gross margins in the long term for both Noden and LENSAR. The company ended the quarter with $284.9m in cash ($134.9m in net cash).