The Chinese central bank has managed to instill some order in both onshore and offshore RMB markets, but at what cost? The amount of intervention that was induced severely strains only the future at those maturities. Central banks are nothing if not short-termists in the purest sense, so repeating what doesn’t work never factors; all that matters is right now.

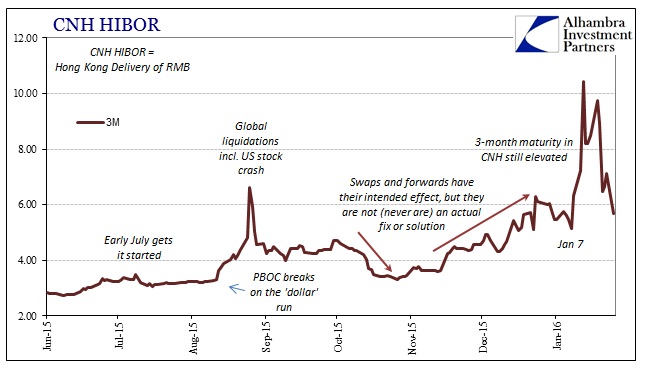

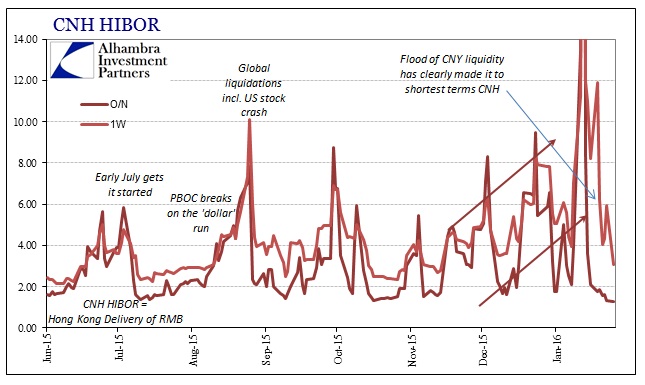

In that sense, the PBOC has re-pegged the CNY exchange rate which has had the added effect of generating more placidity in yuan money markets. CNH money rates which had skyrocketed at the outset of the attempt have been brought under control at least at the shortest maturities. Further out, the 3-month CNH HIBOR rate, for instance, remains severely elevated and suggesting the difficulties or limitations facing this kind of PBOC desperation.

Invoking such large liquidity strides cannot be taken any other way; the PBOC was clearly desperate to have replayed its earlier failure in pegging CNY. The pressures will only build for eruption at some point in the not-enough-distant future. Undoubtedly the upcoming Golden Week holiday was a factor for consideration, as China will again take a break from its prominent Asian “dollar” position. The PBOC is leaving nothing to chance in the short run, therefore also leaving little doubt as to how little confidence remains of liquidity.

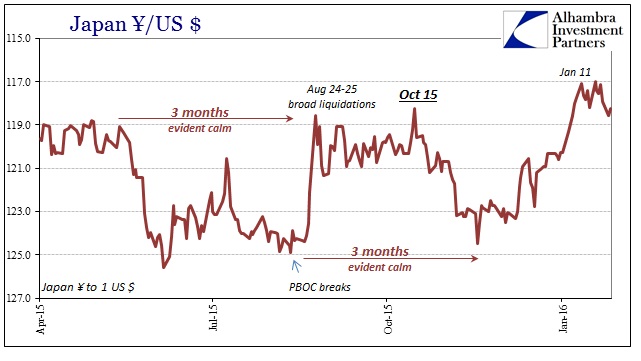

The parallel timing of the CNY/US$ break (from “devaluation”) and the opposite reflection in JPY further directs the notion of these straining circumstances. The Asian “dollar” is undoubtedly at the center of all this, which focuses not just attention upon China’s efforts but also why and how they will ultimately be doomed. As noted consistently, China’s great imbalance, the baseline for all that has transpired, is not China’s to control.

In that respect, China has to respect how “dollar” markets are themselves gaining steady frenzy and complaint, particularly the growing sense of RHINO. As desperate as the PBOC had become by mid-January, from that point forward the Fed may have run itself into even more distressed environments. From the view of purely “dollar” conditions, credit and funding, this side of the global exchange divide, doesn’t appear any better and in fact in many ways suggests only much worse to come (subscription required) – which can only mean an even rougher and more extreme baseline for China when their current interventions inevitably start to mature.

What, exactly, did the PBOC “buy” for its efforts? Nothing but hope, which can only be “cashed” a few times before markets figure out the helplessness.