The U.S. economy added 156,000 jobs in August. What does it mean for the gold market?

Total nonfarm payroll employment increased 156,000 in August, following an increase of 210,000 in June (after a downward revision), according to the U.S. Bureau of Labor Statistics. Analysts had expected 180,000 jobs to be created. Thus, the actual number significantly disappointed expectations.

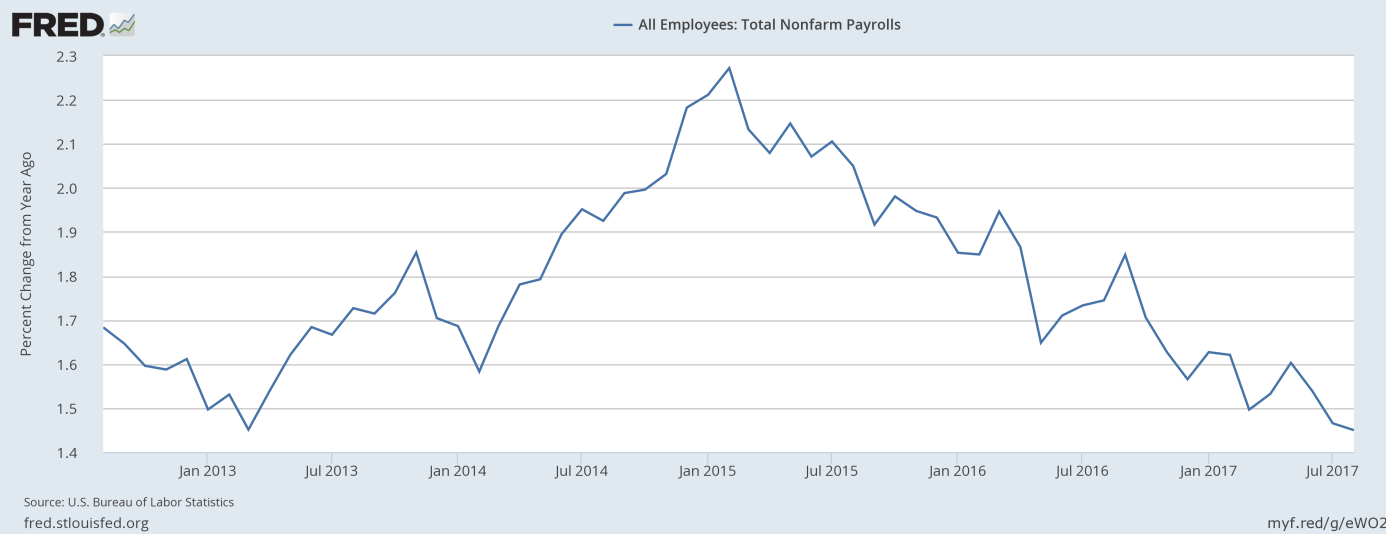

Moreover, employment gains in June and July combined were 41,000 lower than previously reported. It means that job gains in the last three months have averaged 185,000. And the annual job growth rate remains in a downward trend, as the chart below shows.

Chart 1: Total nonfarm payrolls (percent change from year ago) over the last five years.

The employment gains were widespread again. The jobs were created mainly in professional and business services (+40,000), manufacturing (+36,000), construction (+28,000), and in education and health services (+25,000). Moreover, financial activities, mining, trade, leisure and health service hired workers as well. On the contrary, government, information, and utilities cut jobs.

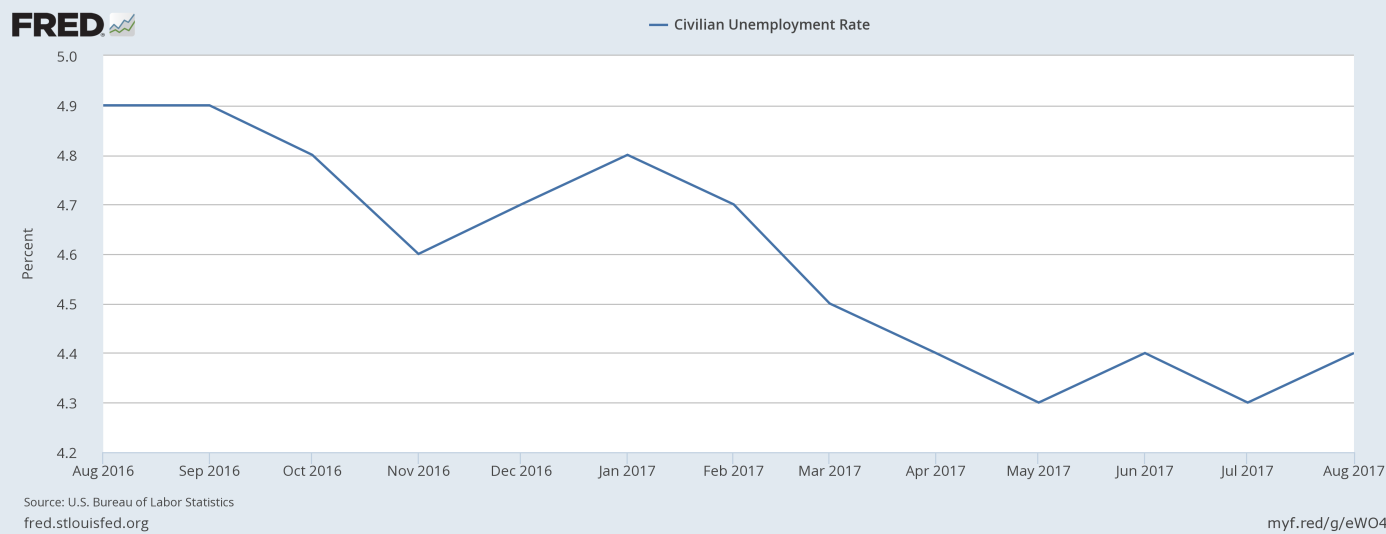

When it comes to other labor market indicators, they were neutral. The unemployment rate increased from 4.3 percent to 4.4 percent, but remains at very low level. And, as the chart below shows, it has been either 4.3 or 4.4 percent since April. The labor force participation rate and the employment-population rate were either unchanged or little changed. And the average hourly earnings for all employees on private nonfarm payrolls rose by 3 cents to $26.39 (or 2.5 percent over the year).

Chart 2: Unemployment rate over the last 12 months.

The take-home message is that August job gains were below forecasts, but still enough to keep the Fed on track to normalize its monetary policy. Hence, the recent employment situation report caused little reaction in the markets and it is unlikely to significantly affect the course of the U.S. monetary policy or the gold market. Investors should remember that the American labor market remains tight, as the economy is adding more job gains than it is needed to keep the unemployment rate stable.

Moreover, the August headline may be low because many surveyed people are on vacation then and do not respond to the governmental statisticians right away, if this is true, we may see a rebound in the near future, which may affect negatively the price of gold (although, the impact of nonfarm payrolls on the gold market has recently diminished somewhat).

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.