Patterson-UTI Energy, Inc. (PTEN) owns and operates fleets of land-based drilling rigs in the United States. Patterson-UTI’s contract drilling business operates in Texas, New Mexico, Oklahoma, Arkansas, Louisiana, Mississippi, Colorado, Utah, Wyoming, Montana, North Dakota, Pennsylvania, West Virginia and western Canada.

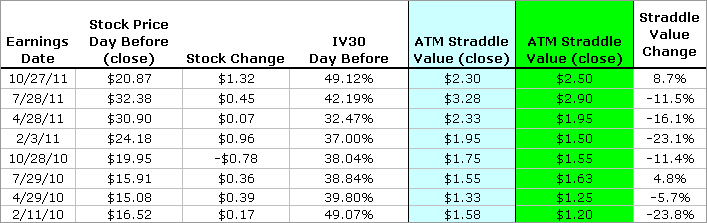

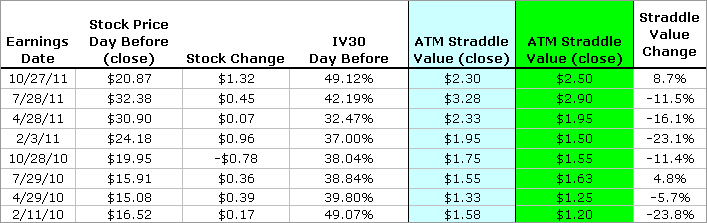

This is a vol note on a stock with earnings fast approaching. Before we look at the charts, let's start with earnings vol and stock analysis. The stats for the last eight quarters are included below

In the third column, we can see that the stock hadn't moved by more than $1.00 (in absolute value) for seven consecutive quarters up until the most recent report (10-27-2011).

In the fourth column we can see the level of IV30™ right before earnings. Note that IV30™ as of this writing is elevated to all of those levels and will likely increase as we approach the earnings date.

In the final (right most) column, we can see that selling the one day straddle and buying it back the next day was a winner six out of eight quarters. But, even the dates when the straddle moved more than implied, the difference was single digits (in percent terms).

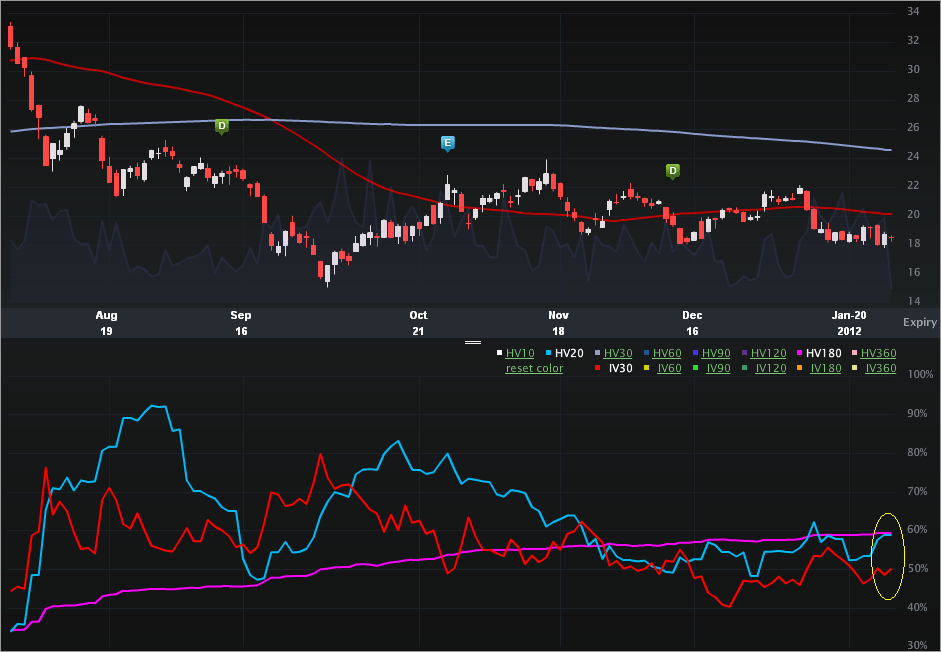

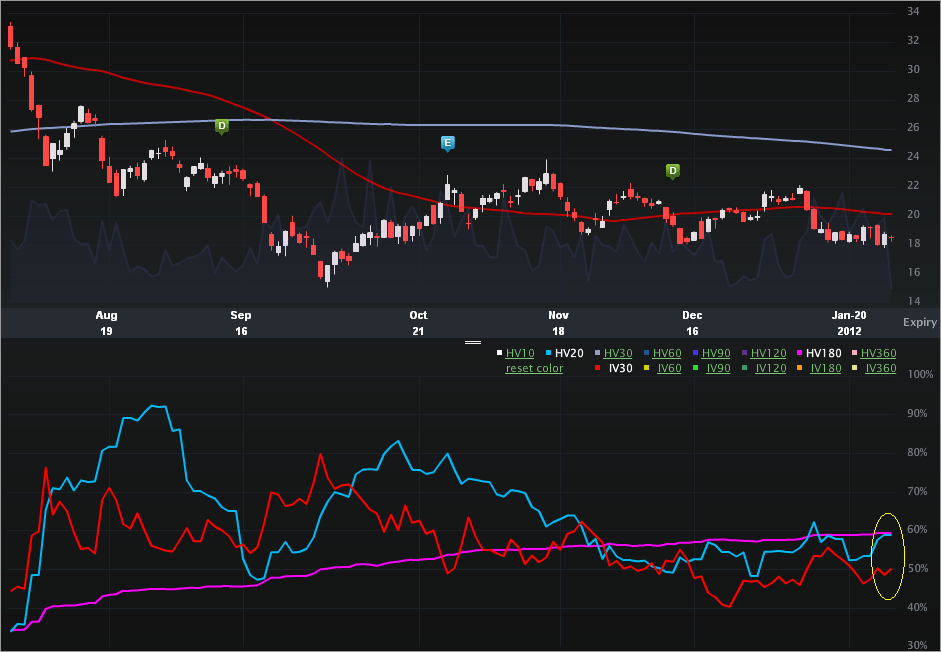

Let's turn to the Charts Tab (6 months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20 - blue vs HV180 - pink).

It's the vol portion that caught me eye -- the implied is trading below both historical measures. Specifically:

IV30™:50.04%

HV20™: 59.03%

HV180™: 59.42%

The 52 wk range in IV30™ is [31.26%, 79.89%], putting the current value in the 39th percentile... with earnings approaching. Again, note that the IV30™ is higher than previous earnings dates -- so this is a convoluted picture of depressed implied to historical measures and to its own history (the percentile), yet somehow elevated to prior earnings periods. Very, very, very weird.

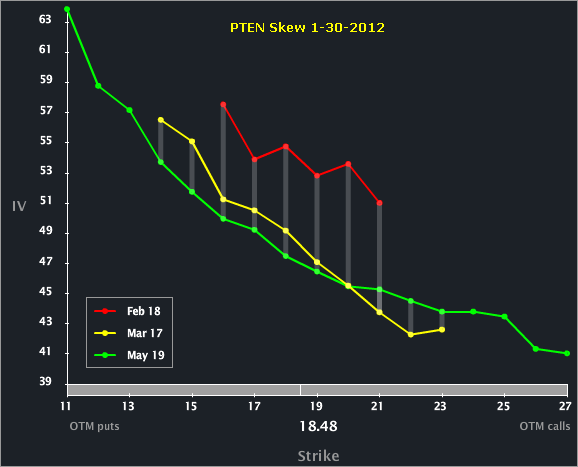

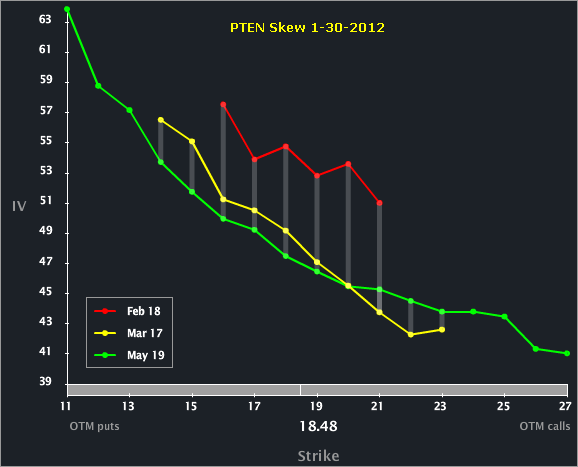

Let's turn to the Skew Tab.

Nothing special here -- we can see that the front is elevated to the back due to the earnings announcement. Other than that, the skew shape is pretty "normal."

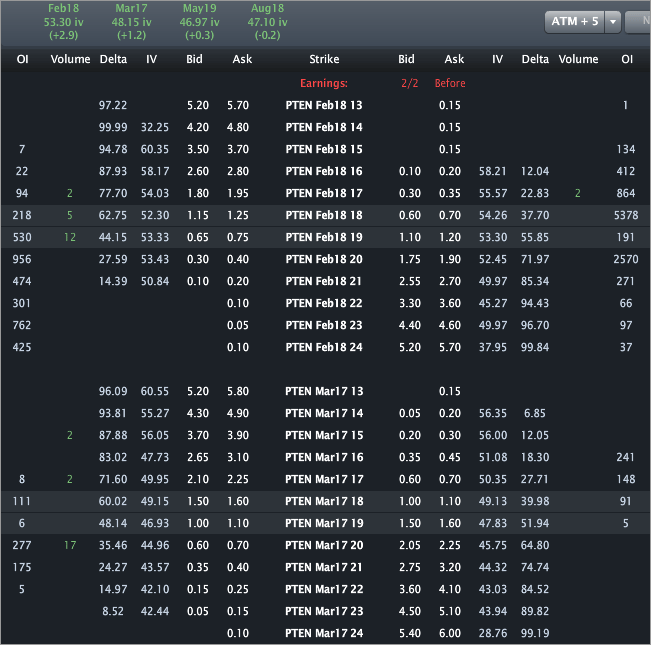

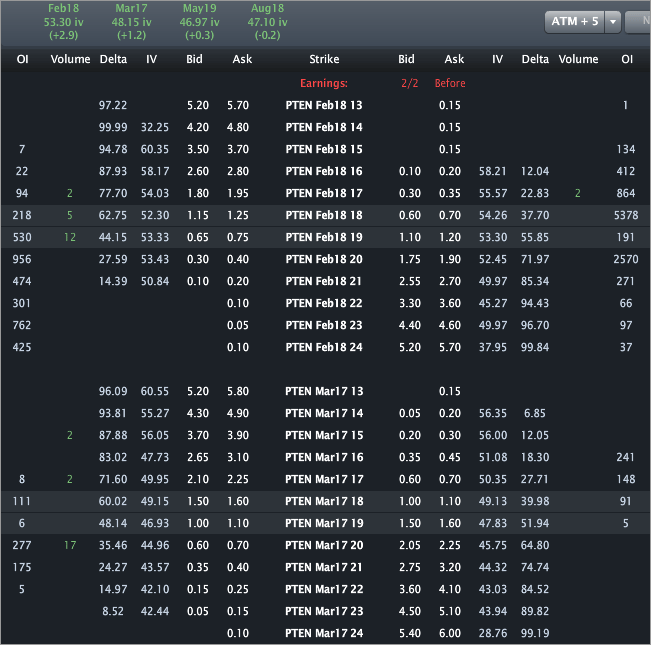

Finally, let's turn to the Options Tab.

We can see that Feb is priced to 53.3% vol while Mar is priced to 48.15%. The ATM (19 strike) straddle in Feb is quoting $1.75 x 1.95.

This is trade analysis, not a recommendation.

This is a vol note on a stock with earnings fast approaching. Before we look at the charts, let's start with earnings vol and stock analysis. The stats for the last eight quarters are included below

In the third column, we can see that the stock hadn't moved by more than $1.00 (in absolute value) for seven consecutive quarters up until the most recent report (10-27-2011).

In the fourth column we can see the level of IV30™ right before earnings. Note that IV30™ as of this writing is elevated to all of those levels and will likely increase as we approach the earnings date.

In the final (right most) column, we can see that selling the one day straddle and buying it back the next day was a winner six out of eight quarters. But, even the dates when the straddle moved more than implied, the difference was single digits (in percent terms).

Let's turn to the Charts Tab (6 months), below. The top portion is the stock price, the bottom is the vol (IV30™ - red vs HV20 - blue vs HV180 - pink).

It's the vol portion that caught me eye -- the implied is trading below both historical measures. Specifically:

IV30™:50.04%

HV20™: 59.03%

HV180™: 59.42%

The 52 wk range in IV30™ is [31.26%, 79.89%], putting the current value in the 39th percentile... with earnings approaching. Again, note that the IV30™ is higher than previous earnings dates -- so this is a convoluted picture of depressed implied to historical measures and to its own history (the percentile), yet somehow elevated to prior earnings periods. Very, very, very weird.

Let's turn to the Skew Tab.

Nothing special here -- we can see that the front is elevated to the back due to the earnings announcement. Other than that, the skew shape is pretty "normal."

Finally, let's turn to the Options Tab.

We can see that Feb is priced to 53.3% vol while Mar is priced to 48.15%. The ATM (19 strike) straddle in Feb is quoting $1.75 x 1.95.

This is trade analysis, not a recommendation.