A couple of Thursdays ago, we were all wringing our hands (or at least I was) about the powerful bureaucrat and lifetime government employee Haruhiko Kuroda and what his next move would be. He dropped a big bomb – negative interest rates – and created precisely the kind of market reaction he wanted………….for less than a single day. Since then, his world has once again fallen to pieces, since the cold fact of the matter is that Japan is doomed to be an old age colony, hopelessly mired in debt, with its economic glory of the 1980s an increasingly distant memory.

Even though these moronic central bankers are becoming increasingly impotent (a trait normally assigned merely to those who dared gaze at the hideous visage of Janet Yellen), we’re all still afraid of them and what they might do, simply because the horrid memories of 2009-2014 are too painful to forget. The latest chatter is about the Chinese government, and whatever falsified data they intend to trot out Sunday night. I personally wish they’d all choke on their chopsticks, but the universe seldom heeds the desires of Tim Knight.

What we must remember, however, is this: we are in a bear market, and the risk of a countertrend rally is present, but confined. Looking at the Dow Jones Composite, for example, I’ve tinted in my view as to the worst risk scenario. God forbid even this happening:

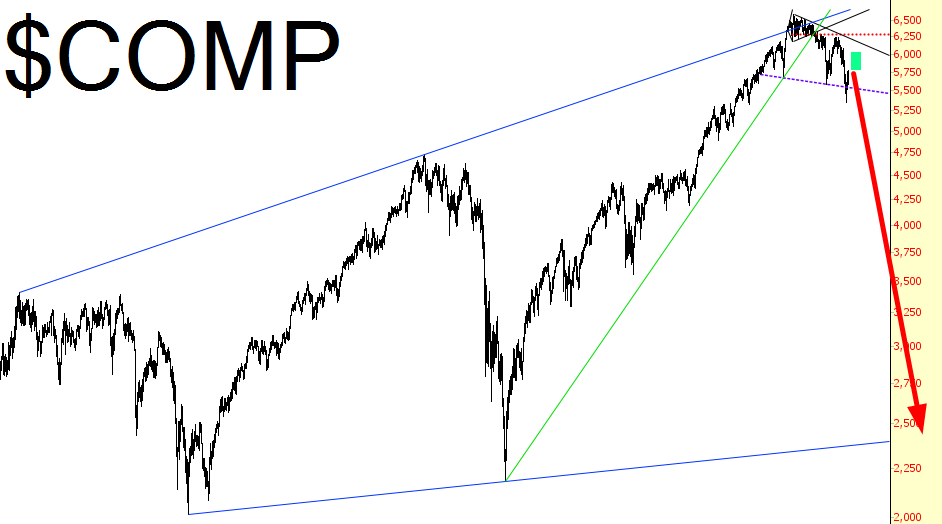

Context is important, however, because the big picture shows global mayhem, economic cataclysm, and a plunge that would push Draghi, Yellen, Kuroda, and the unnamed stooges of China to seek out the cleanest, sharpest razor blades available to slit their collective wrists. I have, as a way to emphasize the contrast between bearish and bullish risk, tinted in green below the same area as I did above. Magnifying glasses may be required:

As you might have divined, I deeply resent these bankers and the fact they have any say-so in market movement, even if this effect is short-lived. My belief in the importance of organic markets flows through every molecule of my being, and what these government flunkies are doing is grotesquely offensive to every concept I have of decency and natural order.

They. Will. Fail.