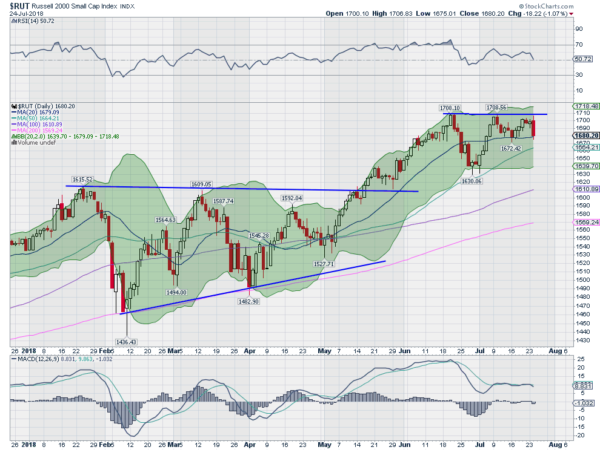

Remember when the Russell 2000 broke out to the upside in May. It looked like the future path was high and small caps would lead the way again. But then it hit resistance at the big round number 1700 in June and stalled. No real damage done then as it pulled back to a higher low and just above the 50 day SMA. It reversed and moved back up to the high at 1700 as the calendar shifted to July. But since then it has stalled.

Consolidating in a 20 point range between 1680 and 1700, the Russell 2000 has moved sideways for 3 weeks. Tuesday gave it a set back, falling from 1700 back to 1680 and the 20 day SMA. It seemed like a strong move lower. And in the pre-market action Wednesday it looks to open to the downside, perhaps continuing lower. So is the road higher damaged for the Russell 2000 now?

Let’s not get ahead of ourselves. First, as noted, the Russell 2000 is still above its 20 day SMA. It still has a RSI in the bullish zone near the mid line and a MACD that is positive. Both momentum indicators can still move lower, and doing so without the index making a lower low would help reset momentum for another leg, a positive thing. A move in the Russell 2000 below the late June low would be more troublesome. But even a retest at the break out level of 1610 would not damage the long term bull case. Below 1610 we can start to talk about a deeper pullback having meaning.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.