Healthcare has been an important and growing sector for the US economy. It also has been a bright spot in the stock market. Another area that has been building steam is the technology sector. So let’s look at one company that bridges the gap between the two. Allscripts Healthcare Solutions (NASDAQ:MDRX) is in that space between, automating the clinical, financial and healthcare records data to make the whole healthcare experience more efficient. How great would it be if some day your doctors would have access to all your medical records on one chart?

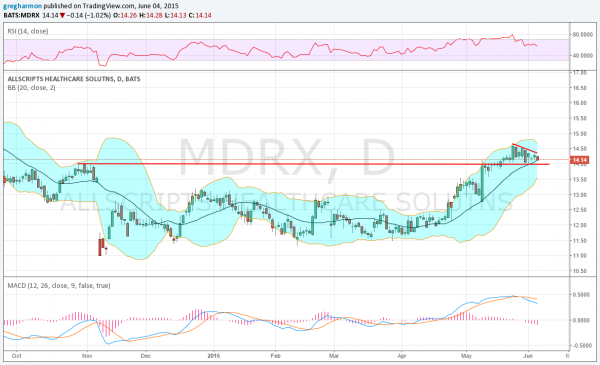

Well the stock price looks healthy, indeed. Since November the price dropped to a low at 11 before bouncing. It then spent 6 months in a range between 11.50 and 13. At the end of April it broke that range to the upside, starting higher.

It paused when it hit 14, the high before the drop in November. This completed a Cup pattern. But then it moved higher to 14.50 before starting the pullback against falling-trend resistance on May 22. It is either creating a descending triangle against that prior high at 14 as support or you can look at the last several days as a symmetrical triangle with the rising 20-day SMA as support against that trend resistance to the upside.

Either the Cup and now Handle, or 1 of the 2 triangles sets up for a move to happen shortly. And with the RSI in the bullish zone, an upside break is the bias. It can obviously break either way, so be prepared. But a break would look for a move of $2.50, so it's worth watching.