Parker-Hannifin Corporation’s (NYSE:PH) operating arm Parker Aerospace recently won a string of contracts which are expected to boost its financials. Parker Aerospace was selected by Rolls-Royce (LON:RR) for supporting an engine development program; offering a thermal cooling system to Kongsberg’s and Raytheon’s Joint Strike Missile (“JSM’) along with providing over 60 types of components to Commercial Aircraft Corporation of China (“COMAC”) C919 engines.

In addition, Parker Aerospace’ joint venture with the Aviation Industry of China (AVIC), Parker FACRI, aims to enhance customer service in China. This in turn will likely bolster the company’s hold in the Asia-Pacific region.

Lucrative Wins

Parker Aerospace’s long standing partner Rolls-Royce has selected the former to support the Rolls-Royce Trent 7000, which happens to be the latest turbofan engine development program, engineered for use in the Airbus A330neo platform. Previously, Parker Aerospace has aided the design of Rolls-Royce Trent XWB and Trent 1000 turbofan engine for the Airbus A350 XWB and the Boeing (NYSE:BA) 787. The latest engine Trent 7000 is an environmentally friendly one and Parker Aerospace’s low-NOx and low-CO fuel atomization technology is ideal for it.

Moreover, Parker Aerospace’s state-of-the-art thermal cooling system will now be deployed by JSM to check the excess heat of anti-ship and land-attack missiles that run on sophisticated operating electronics. Parker Aerospace’s proprietary conduction and thermal capacitance will help in dissipating the heat from the missile’s computational unit and sensors. Also, Parker Aerospace will offer its SprayCool thermal management systems to JSM which help in converting liquid into an inert gas to limit the heat.

In addition, Parker Aerospace will be offering key fluidpower, inerting and motion control systems on the latest C919 models – narrow-body twin-engine jet airliners developed by COMAC and Parker Aerospace. The company offers hydraulic systems, primary flight control, fuel gauging and management, fuel tank inerting system and landing gear conveyance for these engines.

Bolstering Foothold

Parker Aerospace is working toward bolstering its footprint in Asia Pacific. In this regard, Parker FACRI has successfully obtained the much-coveted CAAC 145 and FAA 145 certifications and will soon commence services in China. It will also be offering support to flight control, hydraulic, fuel and inerting equipment developed by Parker-Hannifin and other manufacturers This will ultimately offer faster turnaround time for customers in China.

Parker FACRI is one of the two joint ventures of Parker Aerospace in China, the other one being NEIAS Parker Aero Systems Equipment (NPASE) established in collaboration with AVIC Jincheng Nanjing Engineering Institute of Aircraft Systems. Both these joint ventures were set up with the objective to fortify the leading position of COMAC aircraft systems.

Win Strategy

We believe that the recent wins will offer a major boost to Parker Aerospace’s business which focuses on research, design, manufacture and service of flight components. Apart from these wins, we believe Parker-Hannifin’s “Win Strategy” is a key growth catalyst. The new version of the strategy takes care of facets like customer engagement and experience, profitable growth and better financial performance.

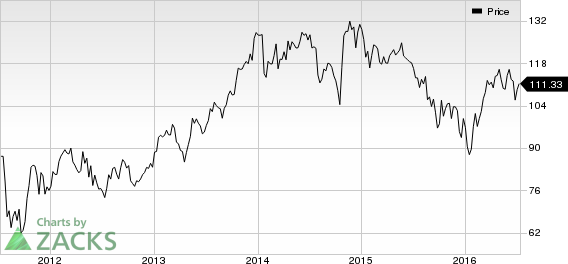

Parker-Hannifin currently holds a Zacks Rank #2 (Buy). Other favorably ranked stocks in the industry include Kadant Inc. (NYSE:KAI) , Nordson Corporation (NASDAQ:NDSN) and Altra Industrial Motion Corp. (NASDAQ:AIMC) ). While Kadant and Nordson sport a Zacks Rank #1 (Strong Buy), Altra Industrial carries the same Zacks Rank as Parker-Hannifin.

PARKER HANNIFIN (PH): Free Stock Analysis Report

NORDSON CORP (NDSN): Free Stock Analysis Report

KADANT INC (KAI): Free Stock Analysis Report

ALTRA INDUS MOT (AIMC): Free Stock Analysis Report

Original post

Zacks Investment Research