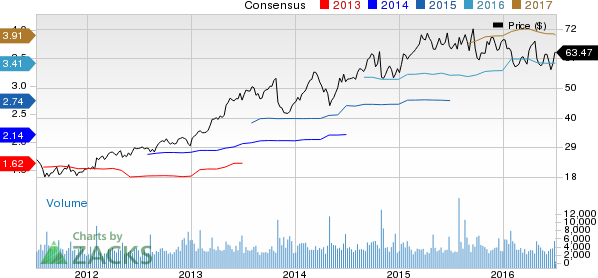

PAREXEL International Corporation (NASDAQ:PRXL) recently provided an update on its long-term growth trends, which reflect its growing clout in the clinical research and consulting market. Following the news, shares of the company rallied a modest 0.9% to close at $63.47 on Jul 1.

The contact research organization (CRO) forecasts annual revenue increase in the 10%-12% range, which is better than the growth reported in recent times. Organic growth is projected in the band of 7%--8%, while acquisitions are estimated to provide 3%--4% of the annual growth.

PAREXEL now expects 100–120 basis points (bps) of annual adjusted operating margin expansion, with the long-term goal of an adjusted operating margin range of 14%–16%. Adjusted earnings are expected to increase in the range of 15%--20% annually.

Oncology, New Medicines Hold Key

Management at PAREXEL noted that the biopharmaceutical pipeline is increasingly shifting to oncology and specialty medicines that have solid demand and provides better margin expansion opportunity. The company noted that more than 225 new medicines are expected to be introduced by 2020, of which one-third will be for cancer. Moreover, two-third of biopharmaceutical sales is expected to be of specialty drugs.

PAREXEL noted that targeted therapies are expected to comprise 91% of novel active substances (NAS) in oncology in the period 2016--2020, which will be the highest since 1997. The company also noted the presence of many “first-in-class” medicines as well as increase in orphan therapy approvals.

PAREXEL’s expertise in clinical research, state-of-the-art technology platforms and data-driven monitoring provide it a competitive edge, in our view. Additionally, new business wins, productivity and cost-control initiatives as well as accretive acquisitions will boost overall results in the days ahead.

Fiscal 2016 Guidance

PAREXEL maintained its fiscal 2016 revenue guidance at $2.085–$2.095 billion and adjusted earnings range at $3.38-$3.46 per share. The Zacks Consensus Estimate is currently pegged at $3.41 on revenues of $2.10 billion.

However, adjusted earnings figure excludes restructuring charges of $47--$52 million related to Margin Acceleration Program (MAP) as well as acquisition-related charges. PAREXEL now expects MAP to achieve the high-end of its pretax savings target of $20–$30 million in fiscal 2016.

PAREXEL also reiterated its fourth-quarter 2016 (ended Jun 30) revenue guidance, which is expected to be in the range of $528-$538 million. Adjusted earnings guidance was also maintained at 89--97 cents per share.

The earnings figure excludes restructuring charges of ($4--$9 million related to MAP as well as acquisition-related charges in the quarter. The Zacks Consensus Estimate is currently pegged at 92 cents on revenues of $533.9 million.

Fiscal 2017 Guidance

For fiscal 2017, PAREXEL forecasts revenues in the range of $2.175-$2.205 billion, up 4%--5.5% on a year-over-year basis. Management noted that trend toward more smaller and complex clinical trials, particularly in oncology, is taking more time to complete. This is delaying backlog conversion into revenues, which is responsible for the sluggish growth.

PAREXEL forecasts adjusted earnings in the range of $3.68--$3.96 per share, which reflects 10%--18% growth on a year-over-year basis.

Zacks Rank & Key Picks

Currently, PARAXEL has a Zacks Rank #3 (Hold).

Better-ranked stocks include AMN Healthcare (NYSE:AHS) , BioTelemetry (NASDAQ:BEAT) and HealthEquity (NASDAQ:HQY) . While AMN Healthcare and BioTelemetry sport a Zacks Rank #1 (Strong Buy), HealthEquity carries a Zacks Rank #2 (Buy).

BIOTELEMETRY (BEAT): Free Stock Analysis Report

AMN HLTHCR SVCS (AHS): Free Stock Analysis Report

PAREXEL INTL CP (PRXL): Free Stock Analysis Report

HEALTHEQUITY (HQY): Free Stock Analysis Report

Original post

Zacks Investment Research