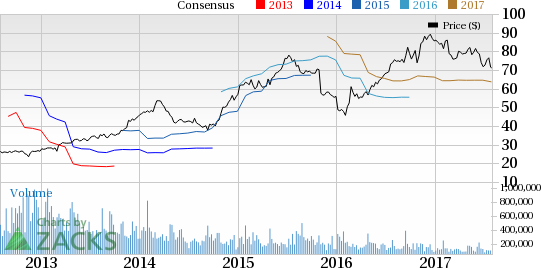

Papa John’s International, Inc. (NASDAQ:PZZA) posted mixed second-quarter 2017 results, wherein earnings beat the Zacks Consensus Estimate while revenues lagged the same.

However, the company’s shares have rallied nearly 8% in after-hour trading on Aug 1 on solid bottom-line performance and increased share repurchase authorization.

Earnings and Revenue Discussion

Adjusted earnings of 65 cents per share beat the Zacks Consensus Estimate of 63 cents by 3.2%. Moreover, earnings increased 6.6% year over year on higher revenues.

Revenues of $434.7 million missed the consensus mark of $456.6 million by 4.8%. However, revenues increased 2.8% year over year buoyed by a rise in North America franchise royalties and fees, higher North America commissary and other sales along with improved international revenues. Adverse forex translations however somewhat marred the results.

Behind the Headline Numbers

Global restaurant sales growth of 4.1% in the second quarter was lower than the last quarter’s rise of 4.9% as well as the year-ago quarter’s 5.9% increase.

Excluding foreign currency impact, global restaurant sales growth was 5.1%, also lower than the prior-quarter and year-ago comps growth of 5.5% and 7.7%, respectively.

Domestic company-owned restaurant sales were down 0.7% in spite of a 2.3% increase in comparable sales.

North America franchise royalties and fees were up 5.1% driven by a 1.1% rise in comparable sales. North America commissary and other sales rose 6.2% on higher volumes and commodity costs.

Comps at system-wide North American restaurants were up 1.4%, lower than 4.8% comps growth in the year-ago quarter and 2% in the last quarter.

International revenues were up 6.2% year over year primarily on positive comparable sales. Currency affected international revenues by $2.5 million. Comps at system-wide international restaurants increased 3.9%, which is lower than comps growth of 5.3% a year ago and 6% in the preceding quarter.

2017 Outlook Updated

For 2017, Papa John’s continues to maintain the adjusted earnings per share growth range at 8% to 12%. Notably, the reaffirmation of the earnings outlook excludes the impact of the raised share repurchase authorization as recently proposed.

North America system-wide comps are still projected to rise in the band of 2% to 4%.

Meanwhile, international comps are expected to be up 4% to 6% in 2017.

Capital expenditures are expected to range between $45 million and $55 million.

However, the company now expects net global new unit growth in the range of 3–4% (earlier 4—5%), primarily to mirror the closure of the stores in the Indian market.

For 2017, the company plans to return additional capital to shareholders through a $500-million increase in share repurchase authorization.

Papa John’s has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Peer Releases

Domino’s Pizza Inc. (NYSE:DPZ) reported a 34.6% increase in earnings to $1.32 in the second quarter of 2017 on strong sales as well as a lower share count. The figure also surpassed the Zacks Consensus Estimate of $1.22 by 8.2%.

McDonald's Corp. (NYSE:MCD) reported second-quarter adjusted earnings per share of $1.73, beating the Zacks Consensus Estimate of $1.62 by 6.8%. Earnings also increased 19% year over year.

Darden Restaurants, Inc.’s (NYSE:DRI) fourth-quarter fiscal 2017 adjusted earnings of $1.18 per share outpaced the Zacks Consensus Estimate of $1.15 by 2.6%. Further, the bottom line surged 7.3% year over year on the back of higher revenues and lower share count.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Domino's Pizza Inc (DPZ): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Papa John's International, Inc. (PZZA): Free Stock Analysis Report

Original post

Zacks Investment Research