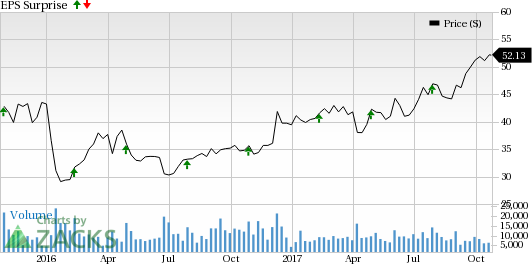

BorgWarner Inc. (NYSE:BWA) is set to release third-quarter 2017 results, before the market opens on Oct 26.

Last quarter, the company delivered a positive earnings surprise of 7.9%. In fact, the company delivered a positive earnings surprise in each of the trailing four quarters, with an average beat of 4.7%.

Let’s see how things are shaping up for the upcoming announcement.

Factors at Play

BorgWarner expects third-quarter 2017 earnings per share in the range of 84-87 cents, higher than 78 cents earned in third-quarter 2016. Organic net sales growth for the quarter is projected in the 3-6% band.

For 2017, the company projects net sales of around $9.28-$9.38 billion compared with the previous expectation of $8.81-$9.04 billion, reflecting an organic growth rate of 6.5-7.5%. The company expects a $100 million negative impact from foreign currencies due to depreciation of the euro, yuan and pound.

A healthy balance sheet and ample cash flow will help BorgWarner return capital to its shareholders. These efforts are likely to positively impact its earnings per share. Also, the company is poised to benefit from its expansion strategy.

Earnings Whispers

Our proven model does not conclusively show that BorgWarner will beat estimates this quarter, as it does not have the right combination of two key ingredients.

Zacks ESP: BorgWarner has an Earnings ESP of 0.00% as both the Most Accurate estimate and the Zacks Consensus Estimate are pegged at 87 cents. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: BorgWarner currently carries a Zacks Rank #2 (Buy). Note that stocks with a Zacks Rank #1 (Strong Buy), 2 or 3 (Hold) have a significantly higher chance of an earnings beat.

Conversely, Sell-rated stocks (Zacks Rank #4 or 5) should never be considered going into an earnings announcement.

Stocks to Consider

Here are a few other stocks in the auto industry you may consider as our model shows that they have the right combination of elements to post an earnings beat this quarter.

Dorman Products, Inc. (NASDAQ:DORM) has an earnings ESP of +3.05% and carries a Zacks Rank #3. The company is expected to report third-quarter 2017 financial results on Oct 27. You can see the complete list of today’s Zacks #1 Rank stocks here.

Horizon Global Corporation (NYSE:HZN) has an earnings ESP of +5.82% and carries a Zacks Rank #3. The company’s third-quarter 2017 results are expected to release on Oct 31.

Magna International Inc. (NYSE:MGA) has an earnings ESP of +1.91% and carries a Zacks Rank #2. The company’s third-quarter 2017 financial results are expected to release on Nov 9.

Today’s Stocks from Zacks’ Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

BorgWarner Inc. (BWA): Free Stock Analysis Report

Magna International, Inc. (MGA): Free Stock Analysis Report

Horizon Global Corporation (HZN): Free Stock Analysis Report

Dorman Products, Inc. (DORM): Free Stock Analysis Report

Original post

Zacks Investment Research