Pan African Resources (PAF.AIM) has announced that it has successfully commissioned its Barberton Tailings Retreatment Project (BTRP) ‘on schedule and within budget’ and conducted its inaugural gold pour. The project will now ramp up to its full 100ktpm capacity by September and, at US$800/oz costs and with 90% of capex already invoiced, contribute rapidly to positive cash-flows.

BTRP

The BTRP’s reserves have been well drilled and, coupled with a flexible mining method, therefore allow the mined grade to be managed in line with the gold price. Phase I of the operation (mining the 3Mt Bramber and 3Mt Harper dumps) has a life of six years, after which the option exists to mine the 6Mt Consort dumps for a capital investment of ZAR55m (US$5.5m) to install a ball mill. The potential also exists to process the Sheba dumps, in which case material could be transported underground for processing, thereby avoiding the intervening hills/mountains.

Evander (EGM) and Phoenix

The BTRP ramp-up occurs at a time in which EGM is entering a 12 month low grade cycle at 8 shaft (forecast yield 7.0g/t in FY14) before recovering once the high grade areas of the Kinross pay-shoot are more fully developed. In the intervening time, management are studying two potential projects: 1) a ball mill to replace an underground autogenous mill in order to process fine, high grade (0.8-1.2g/t) surface material close to the Winkelhaak plant, to produce 500-650oz/mth and adding two years to the life of surface operations and 2) the opening up of the old 7 shaft gold section to access the 2010 pay channel currently locked up in the flooded number 3 decline. Studies relating to the Evander Tailings Retreatment Project remain on-going. In the meantime, the water streams relating to Phoenix have been separated so that the plant is no longer affected by current arisings of oxide material. Simultaneously, Phoenix is expediting an additional tailings storage facility to be completed in Sept that will allow it to bypass the oxidised tailings and increase recoveries. Targeted production in FY14 is 700oz/mth precious metals.

Valuation: Long term remains intact

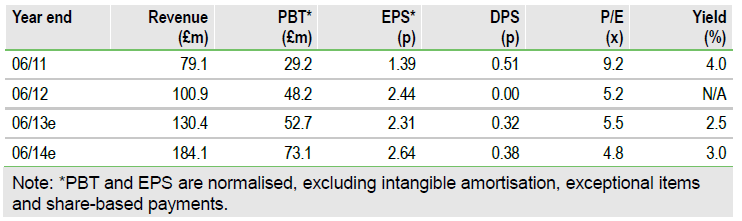

While Edison’s long-term gold price forecast remains US$1,676/oz, it has revised its short term forecasts to US$1,365/oz and US$1,633/oz in FY14 and FY15, respectively, which has inevitably affected short-term forecasts. Nevertheless, the NPV10% of the (maximum potential) dividend stream to investors to 2039 is still 29.5p. In the meantime, its two-year diluted (reported) P/E ratio declines to 5.2x in FY14 cf AngloGold Ashanti’s 7.5x and Gold Fields’ 11.3x (source: Bloomberg).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Pan African Resources:Long Term Valuation Remains Intact

On time and budget

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.