BTRP success; ETRP poised on the blocks

Pan African Resources Plc's, (PAFR) H1 results to end-December were its first with Evander fully consolidated for the entire period. Despite a lower gold price, frequent power interruptions and the febrile environment in the South African mining industry generally, PAF recorded an 11.8% increase in EPS in sterling terms compared to the previous year period. In total, the company produced 96,507oz of gold (193koz annualised) at a cash cost of US$834/oz. It has a target of producing at an annualised rate of 250koz within 12 months (ie Q1 calendar 2015).

One down; one to go

PAF’s target of a 250koz annualised production rate will be achieved by a return to a higher-grade mining cycle at Evander (99koz in FY16), continuing steady-state production at Barberton (96koz), 26koz from the Barberton Tailings Retreatment Project (BTRP) plus production from the Evander Tailings Retreatment Project (ETRP). A feasibility study for the ETRP was concluded in November and is currently being reviewed by the Pan African board ahead of a production decision expected later this month. Given the infrastructure already in place at Evander – eg tanks, electric power, pumping equipment, security fence etc – and the fact that it will require only minimal incremental opex to effect (eg an additional 10 employees only), we regard it as highly likely that a positive production decision will be forthcoming. Early indications are that the ETRP will require capex of c US$16m for an operation treating 12Mtpa to produce 49koz gold per annum (ie adding approximately 25% to current production).

Valuation: 40 US cents per share absolute

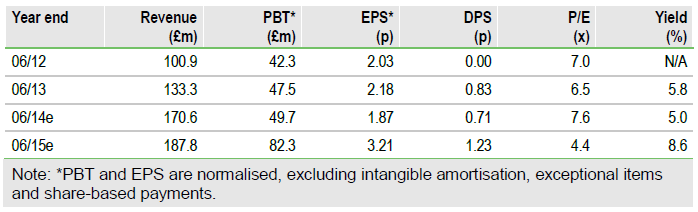

In our last note, we calculated a value for Pan African of 45c, based on the maximum potential dividend stream payable to investors from its four assets until 2039, using a 10% discount rate and a long-term gold price of US$1,676/oz. Since then, we have adjusted our gold forecasts lower (see Exhibits 6 and 7 on page 8). While this has inevitably reduced our EPS forecasts, they nevertheless range between 1.9p and 3.2p over the next 12 years (ie up to 67% higher than our current year forecast). In the meantime, our absolute valuation has reduced only marginally, to 40c/share. Of arguably more significance, Pan African trades at a 42% Year 2 EV/EBITDA discount relative to its South African-listed peers (see Exhibit 9 on page 9) and an 86% Year 2 P/E multiple discount. By contrast, its dividend yield is between three and five times higher and offers investors an income return in excess of 5% before capital appreciation.

To Read the Entire Report Please Click on the pdf File Below