Déjà vu all over again – full dividend reinstated

Headline earnings of £35.2m (+20.1% compared to FY12) were closely in line with Edison’s estimate from 11 September of £36.9m (a full analysis is provided overleaf). Of more significance, a dividend pay-out to shareholders was reinstated at a cover ratio relative to headline EPS (2.6x) that was comparable to the ratio before the Evander deal (and associated capex) was proposed in FY12. Pan African Resources Plc, (PAFR) is now targeting production at a rate of 250,000oz pa from its current asset base and infrastructure within 18 months.

Challenges managed

Group total cash costs were 5.0% higher than FY12 at US$815/oz, despite notable operational challenges, such as a 16.1% increase in labour costs at Barberton (in rand terms), a 15.0% increase in electricity costs and the failure of the 8 shaft rock winder bull gear and a refrigeration plant and booster fan at Evander.

88% of resources yet to be turned to account

Compared to a current figure of 35.1Moz, the lifetime operations of Barberton, BTRP and Evander will deplete Pan African’s resource base by a mere 4.2Moz (ie 12%), leaving c 30.9Moz yet to be exploited. In the short term, there are at least four initiatives being evaluated to bring these ounces to account, including Evander 7 shaft sweepings and vamping (now commenced), the Evander Tailings Retreatment Plant and the reopening of the No. 3 decline at Evander 7 shaft (currently flooded) to access the 2010 pay-channel. Major, longer-term projects include Rolspruit, Royal Sheba, Evander South and Poplar. NB Neither residual resources nor any of these projects form any part of the valuations below.

Valuation: 30p valuation from just 12% of resources

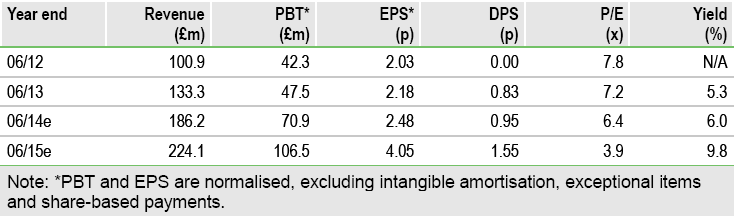

Assuming that the gold price reverts to Edison’s long-term forecast of US$1,676/oz, based on its long-term correlation with the total US monetary base, our longer-term earnings forecasts remain substantially unchanged in excess of 4p/share. On this basis the net present value of the (maximum potential) dividend stream to investors is 29.87p in absolute terms (discounting at 10% pa). At the current share price of 15.75p, this offers investors an internal rate of return of 21.3% to 2039. Otherwise, PAF’s two-year diluted forecast P/E ratio declines to 4.0x in FY15 – cf AngloGold Ashanti (16.3x) and Gold Fields (16.3x) to December 2015 (source: Bloomberg) – while its EV/EBITDA ratio declines to 4.1x, cf Anglogold Ashanti (4.8x) and Gold Fields (4.7x). At a flat gold price of US$1,300/oz, PAF’s diluted forecast P/E ratio rises to only 5.9x; its forecast yield nevertheless remains over 5%.

To Read the Entire Report Please Click on the pdf File Below.