The completion of its ZAR703m, 25.5 per 100 rights issue at 14p per share effectively completes the financing requirements for Pan African’s acquisition of Evander Gold Mines from Harmony later this year. As such, it removes financing risk from the transaction, rending a successful outcome more likely and increasing confidence in Edison’s updated valuation for PAF of 29.83p/share (at a long-term price of US$1,676/oz Au).

Principal remaining condition precedents

The two principal condition precedents remaining to be fulfilled prior to the closure of the transaction are Evander’s entering into an acceptable electricity supply agreement with Eskom (which may be waived by PAF) and Section 11 Ministerial Consent, “which is required to be obtained no later than 30 June 2013.”

EGM effect on Pan African

September quarterly results from EGM demonstrated a recovery in tonnes milled to ostensibly the target milling rate and an encouraging 14.6% decline in unit working costs to ZAR1,741/t, which is within 2.7% of PAF’s target unit cost of ZAR1,696/t. Since 1 April, earnings from EGM have been available to reduce the total consideration of ZAR1.5bn payable by Pan African to Harmony. After the closing date, EGM will be fully consolidated. Edison’s current forecasts assume that the acquisition will be concluded imminently and that EGM will be consolidated into PAF’s accounts from January 2013.

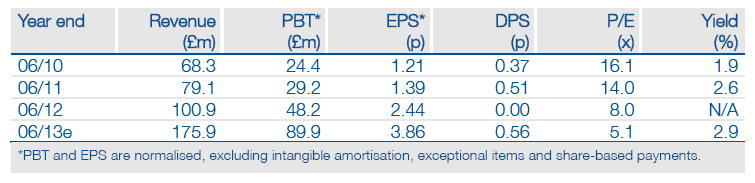

If closure of the transaction is delayed until 30 June, Edison forecasts that PAF will instead announce revenue of £121.0m for FY13, normalised profit before tax of £59.3m, EPS of 2.40p and a dividend payment of c 0.34p per share. These compare to unaudited, pro-forma headline EPS of 2.37p in FY12 after both the EGM transaction and rights issue (on the assumption that both were executed on 1 July 2011).

Valuation: Up 44% on updated gold price and ZAR

Aside from the details of the rights issue, Edison’s forecasts for Pan African have been adjusted to reflect both the recent weakness of the rand in the foreign exchange markets and also Edison’s updated long-term gold price of US$1,676/oz. As a result, Edison’s updated absolute valuation of Pan African, based on a maximum potential dividend flow discounted at 10% per annum, has increased by 43.6%, from 20.77p per share (see note dated 11 September 2012) to 29.83p per share currently. Assuming the successful acquisition of Evander, PAF’s enterprise value will equate to US$17.11 per resource ounce excluding surface resources, or US$14.60/oz including estimated surface resources.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Pan African Resources Moves Ahead in Evander Gold Mines Acquisition

Published 01/23/2013, 04:39 AM

Updated 07/09/2023, 06:31 AM

Pan African Resources Moves Ahead in Evander Gold Mines Acquisition

Oversubscribed and some

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.