Pan African Resources' (PAF.L) FY12 results were closely in line with Edison’s expectations. On-mine revenue increased by 27.6% in GBP terms (aided by a 24% increase in the gold price in US$), while costs of production rose by only 1.7% to result in a 70.3% increase in profit after tax to £29.2m (vs Edison’s expectation of £29.0m).

Total cash costs per oz down to US$776/oz

Total cash costs declined to US$776/oz (cf US$781/oz in 2011 and US$786/oz in H1), after increases in electricity (+27% y-o-y), engineering and technical services (+22%) and labour (+19%) in rand terms were offset by a decline in the ZAR/£ exchange rate and declines in security (-13%) and processing (-5%) costs.

H2 vs H1

Overall, results in H2 were very similar to H1, with the exception of ‘other’ costs relating to corporate activity (eg EGM and Manica), which increased 135% and the tax charge, which fell 45% after the gold mining income tax formula was reduced on the introduction of a dividend withholding tax to replace the secondary tax on companies.

Other operations – Phoenix and Bramber (BTRP)

After hot commissioning in April and completion of its ramp up in July, Phoenix is now reported to have reached ‘steady state’ production of 800-1,000oz per month. In the meantime, construction at Bramber has started and commissioning is scheduled for July 2012, followed by a period of production build up.

Valuation: EGM acquisition earnings accretive

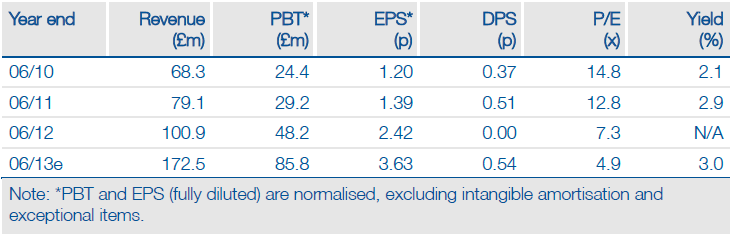

Edison’s estimate of EPS for FY13 remains substantially unchanged at 3.73p/share, principally as a result of the anticipated contribution from Evander. This is in line with EGM’s reported net profit of £21.9m in the six months to December 2011, which equates to an annualised net profit of £43.8m, or 2.4p per PAF share (post rights). On the basis of current mine plans, Edison calculates that EGM will add an average of over 1.0p per share to PAF’s EPS until FY22, which is significant when compared with reported FY12 headline earnings of 2.03p/share. On the basis of our current estimates (including Bramber and Phoenix), Pan African’s P/E ratio declines from 7.3x diluted normalised EPS in FY12 to 4.9x in FY13 – materially cheap compared to other multi-asset South African based producers such as Anglogold Ashanti (c 7x consensus earnings in FY13) and Gold Fields (c 6.5x).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Pan African Resources FY12 Results: In Line

Published 09/30/2012, 05:11 AM

Updated 07/09/2023, 06:31 AM

Pan African Resources FY12 Results: In Line

Smooth transition into new era

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.