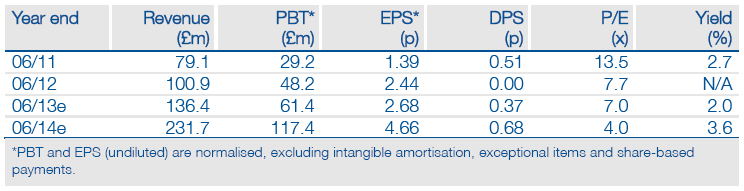

Pan African (PAF.L) has announced that the last remaining condition precedent to closing the Evander transaction (namely receipt of consent from the Department of Mineral Resources (DMR) in accordance with section 11 of the Mineral and Petroleum Resources Development Act, No. 28 of 2002) has now been met. As a result, the transaction is now unconditional and Pan African will assume de jure control of Evander from 28 February 2013. From that date, the financial results of Evander will be consolidated into those of Pan African. As such, Pan African’s full-year results to 30 June 2013 will therefore include four months of contributions from Evander, compared to a previous Edison assumption of six months. Forecasts have now been adjusted to reflect this, including an expected resumption of dividend payments.

Interim results

Notwithstanding a 15% decline in first-half EPS compared to the previous year period, Pan African once again demonstrated its exceptional status and nature in the South African precious metal mining industry, avoiding the labour unrest bedevilling much of the sector by bringing its wage rates up to Chamber of Mines levels and spending up to 5% of its profits on social welfare projects. Moreover, this result was achieved despite a mechanical failure of the winder at Sheba, an estimated 2,454oz of gold locked up in the Biox plant at Barberton, a 19% increase in electricity costs (approximately 12% of the total) and below-budget metallurgical recoveries at Phoenix due to the enforced treatment of oxide tailing through a sulphide plant.

Valuation: Still 30p in absolute terms; relatively cheap

Edison has adjusted its full-year earnings forecasts for Pan African downwards in FY13. However, this principally reflects no more than a two-month delay to the assumed completion of the EGM acquisition, from end-December to end-February, at which point Evander will be fully consolidated into Pan African’s accounts. Otherwise, assuming Phoenix reverts to plan in seven months and that the BTRP is commissioned by end-June, Edison’s longer-term earnings and (maximum potential) dividend forecasts remain substantially unchanged in excess of 4p per share, on which basis the net present value of the (maximum potential) dividend stream to investors in 2013 is 30.

2p in absolute terms (discounting at 10% per annum), ie offering investors at the current share price of 18.75p an internal rate of return of 18.0% to 2039. Of arguably more significance for a multi-asset company with blue-sky exploration potential, on the basis of our current estimates, PAF’s two-year diluted forecast P/E ratio declines to 4.2x in FY14 – a c 31% discount to both AngloGold Ashanti (6.1x) and Gold Fields (6.4x) – while its EV/EBITDA ratio declines to just 2.3x, compared with Anglogold Ashanti (3.2x) and Gold Fields (3.1x).

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Pan African Resources Evander Transaction Complete

Published 02/18/2013, 11:59 PM

Updated 07/09/2023, 06:31 AM

Pan African Resources Evander Transaction Complete

There!

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.