Evander trending higher

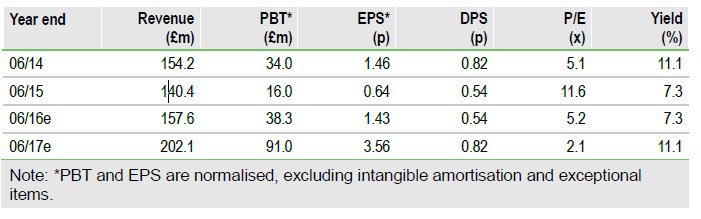

As is now virtually a semi-annual event, Pan African (L:PAFR)) has released a trading statement under paragraph 3.4 (b) of the JSE listing requirements stating that its H116 results will differ by at least 20% from H115. In this case, PAF has indicated that headline EPS (HEPS) will be at least 65% higher than the 0.31p per share reported in H115 in sterling terms – ie at least 0.51p/share including an estimated 0.12p in exceptional hedging profits. The announcement broadly confirms our estimates for both the half and full years and suggests that the expected unit cost reductions and head grade increases at Evander in particular are indeed materialising.

Cash flows positive and net debt contained

In addition to its HEPS guidance, PAF has reported that its net debt position is ZAR70m at present – equivalent to £3.2m before payment of the group’s final dividend of £9.9m, suggesting ex-dividend net debt of £13.1m and thereby implying c £4.9m of cash inflows to date in FY16, or c £5.9-7.4m pro-rata for H116. In this respect, PAF’s H2 is anticipated to demonstrate a material improvement over H1, such that net debt will be well contained within the limits of its ZAR800m (expandable) revolving credit facility, even after payment of an FY16 dividend and ZAR200m consideration for Uitkomst (excluded from our forecasts).

To Read the Entire Report Please Click on the pdf File Below