Palo Alto Networks (NASDAQ:PANW) stands as a leading cybersecurity company specializing in next-generation firewall and cloud security solutions. Its offerings include advanced threat prevention, secure access, and automated policy management, which are designed to protect enterprise networks from evolving cybersecurity threats.

Key highlights:

- Palo Alto Networks' announcement of a Quantum Random Number Generator (QRNG) Open API framework in January 2025. The introduction of an Open API framework for QRNG would enable organizations to integrate quantum randomness into their security systems, enhancing the strength of cryptographic keys and protocols.

- Strong investment in AI-driven security solutions, particularly through Cortex XSIAM platform, could see significant growth as organizations increasingly leverage AI and machine learning for security.

- The company reported AI ARR of approximately $250 million last quarter and secured a $1.65 billion contract with UK's Emergency Services Network over seven years.

- Partnership with IBM for AI-powered security offerings strengthens position in the emerging AI-driven security market.

Though Increasing competition in cloud security, especially from specialized vendors like Wiz, could impact Palo Alto Networks' market share.

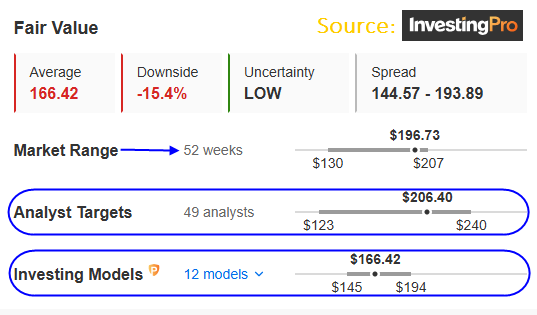

According to InvestingPro's Fair Value estimate, the stock is currently overvalued, with a 15.4% downside.

Subscribe to InvestingPro for less than $9 a month to learn the Fair Value of every stock in the market! Pro members also get to follow the live lists of the Most Undervalued and Most Overvalued stocks in the market in real time.

PANW Q2 2025 earnings are scheduled for 4:05 pm ET Thursday February 13, 2025

|

PANW Earnings Statistics from Q2 2022 |

|||

|

EPS |

1W % move post earnings |

2W % move post earnings |

1M % move post earnings |

|

BEATS 12 |

10.04% |

10.37% |

6.84% |

|

MISSES 0 |

No EPS miss |

No EPS miss |

No EPS miss |

12 beats since Q 2022

0 Misses

|

Analyst Ratings |

|||

|

SOURCE |

BUY |

HOLD |

SELL |

|

Refinitiv |

39 |

12 |

3 |

|

TipRanks |

30 |

6 |

2 |

|

Earnings Expectation |

|

|

EPS |

0.78 USD |

|

Revenue |

2.24B USD |

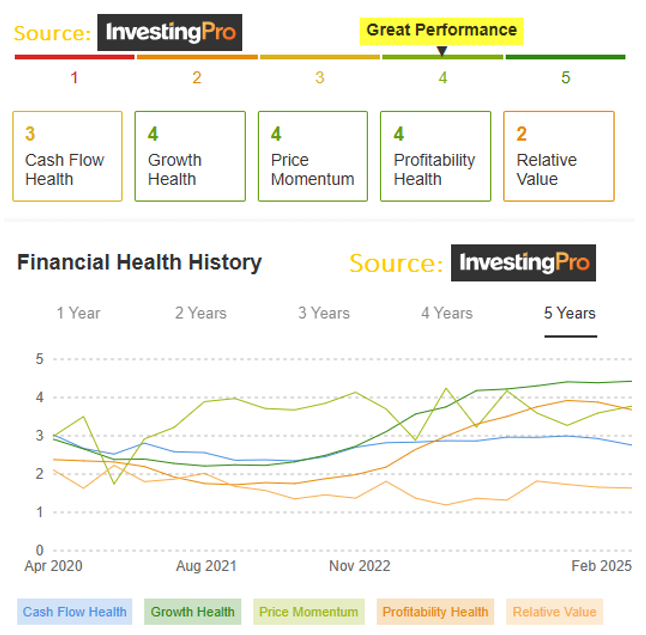

Financial Health History

Financial Health for Palo Alto Networks is determined by ranking the company on over 100 factors against companies in the Information Technology sector and operating in Developed economic markets.

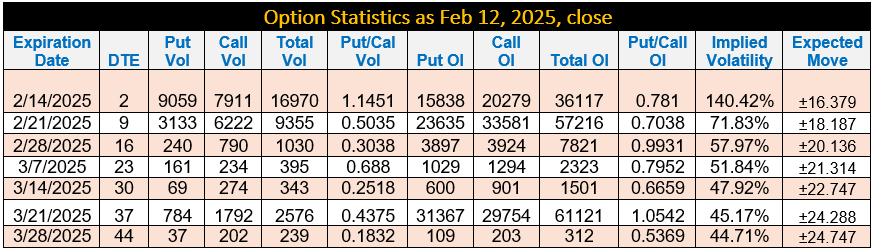

Option Statistics:

Put/Call ratio suggests the following three scenarios:

- With Put/Call ratio between 0.7038 to 0.9931 for the next four upcoming expiries suggest that the overall option traders’ position is neutral to range trade scenario.

- Lower earnings and guidance could trigger a gradual sell-off followed by a slow rise in the stock price.

- Better than expected guidance would trigger a slow rally as increasing competition in cloud security is likely to contain gains.

Technical Analysis Perspective:

- PANW has been trading inside a rising wedge like formation since August 2023.

- Rising wedge resistance is at 207/211 while the rising support is coming into picture at 178/170.

- Technically, a rising wedge is a bearish patten initiated once the lower support at 170 is strongly penetrated on the downside.

- In the meanwhile, stock is likely to range between 211 to 170 post earnings. A breakout on either side would lead trend direction.

- PANW has never missed its earnings in the past. It will be more of a guidance play than earnings.

Weekly Candlestick Chart

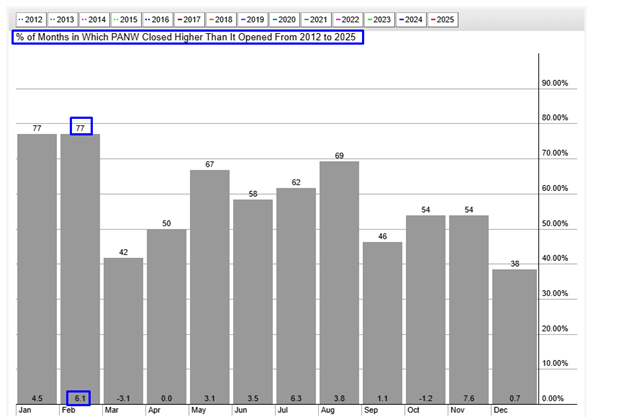

PANW Seasonality Chart:

- PANW closes 6.1% higher in February 77% of the time since 2012.

Ali Merchant is a seasoned financial market professional with expertise in Technical Analysis, Treasury & Capital Markets, Trading, Sales, Research, Training, Fund & Relationship Management, Fintech, and Digitalization. He is a CMT charter holder and an active member of CMT Association, USA, American Association of Professional Technical Analysts, and CMT Association of Canada. He has worked on various roles and organizations in North America and the GCC, such as ABN Amro bank, Thomson Reuters (NYSE:TRI), Refinitiv, MAK Allen & Day Capital Partners (WA:CPAP), and Bridge Information Systems.

He is the founder of TwT Learnings, provides financial market training. Follow us on “X” formerly Twitter “@twtlearning.”