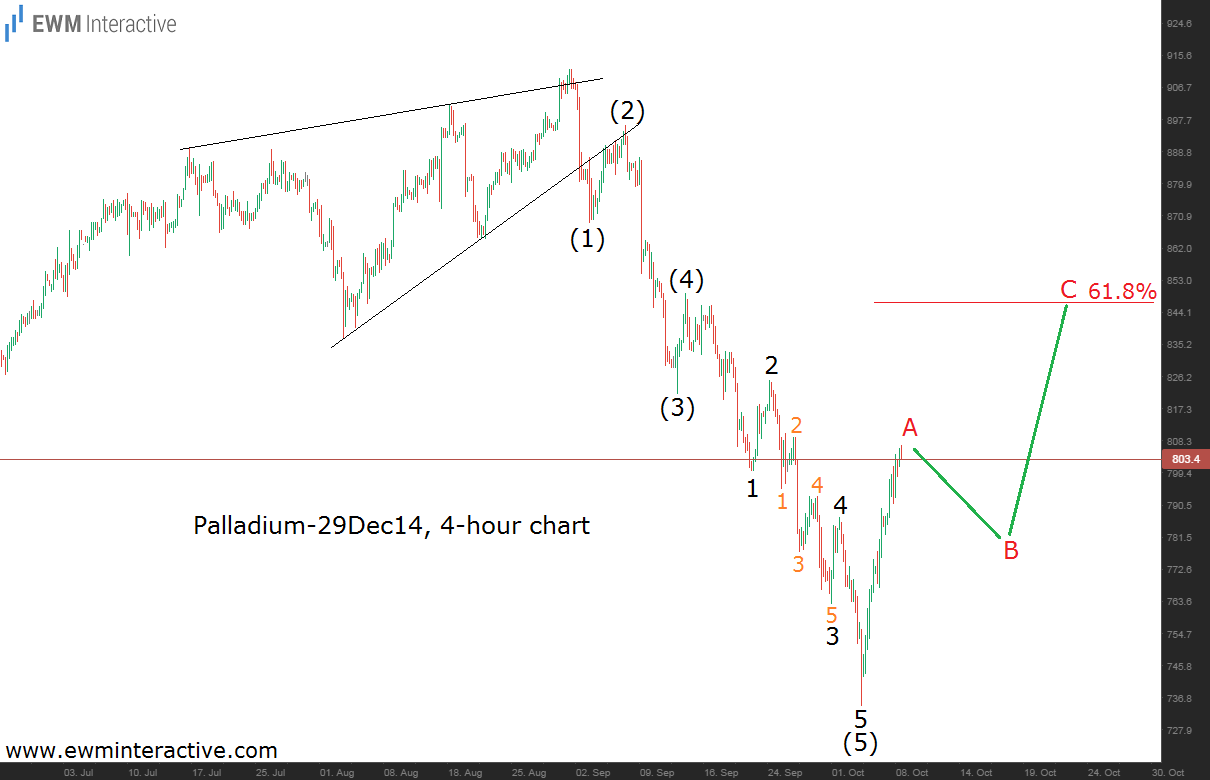

Palladium bounced up sharply from the bottom at 735 and is currently trading above 800. This renewed bull’s strength comes after a decline of nearly 200 figures, that started from the highs of 912. What should traders expect from now on?

Palladium, as any other widely traded instrument, obeys the laws of collective market psychology, which allows us to analyze its price movement through the perspective of the Elliott Wave Principle.

On the above-shown chart you can see that the sell-off began after the completion of an ending diagonal pattern. Probably that is why prices fell down so fast. When Ralph Nelson Elliott described what happens after ending diagonals, he said that they are usually followed by “a swift and sharp reversal”. Just like now. What interests us now is the wave structure of this decline. It seems to be an impulse with an extended fifth wave. In such cases the theory provides us with another guideline: extended fifth waves tend to be fully retraced. This means that the leap from 735 has to be the first part of an A-B-C correction, which has the potential to lead the price of palladium back to the level, where wave (5) had started – close to 850. Furthermore, this area coincides with the 61.8% Fibonacci level, where corrections often terminate. If this is the correct count, palladium should be in the middle of a temporary recovery, which still has a lot to progress.