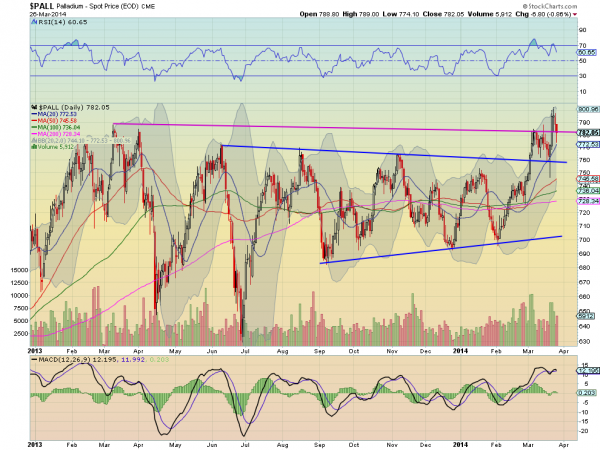

Palladium broke out above a symmetrical triangle in early March. It stalled when it reached the previous high made during March 2012 and fell back to retest the triangle before moving back higher to new highs. My friend JC Parets at allstarcharts was all over this, so nice work.

It has now fallen back to retest that prior high, but the Hammer candle we saw on Wednesday suggests it may be ready to launch toward the target of the triangle breakout at 855. I do not know if JC is still long, but if he is I wish him luck. Not only because he is a nice guy but because Palladium seems to be the only metal that is acting strong.

Gold broke its downtrending resistance on Valentine’s Day but has been pulling back since St. Patrick’s Day and is back at the breakout level and looking weak. Is it a coincidence it went strong into the love holiday and started to fall on the drinking holiday? Hmmm.

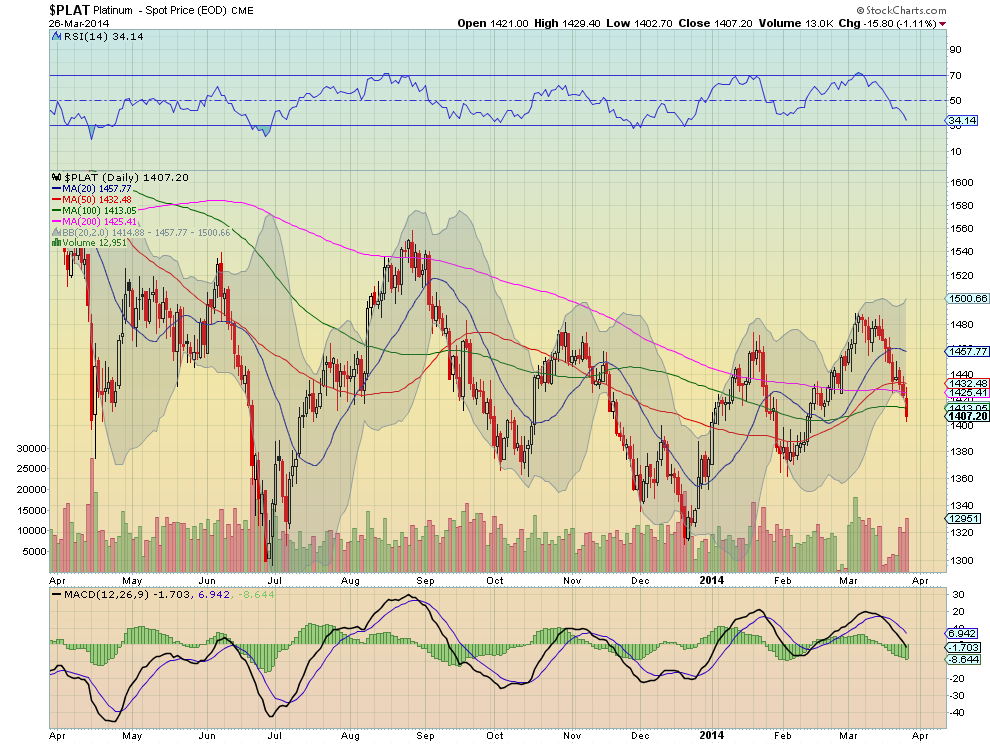

Silver is in even worse shape, peaking in late February and turning what initially looked like a Cup and Handle into a disaster. Then there is Platinum which made a higher high on March 5th but since the Ides of March has been pulling back, accelerating yesterday. The prior low at 1361 does not seem out of reach. For now, Palladium is defying gravity as it holds at higher levels. Will it help the others find support or will it give it up and fall back into the prior consolidation?

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.