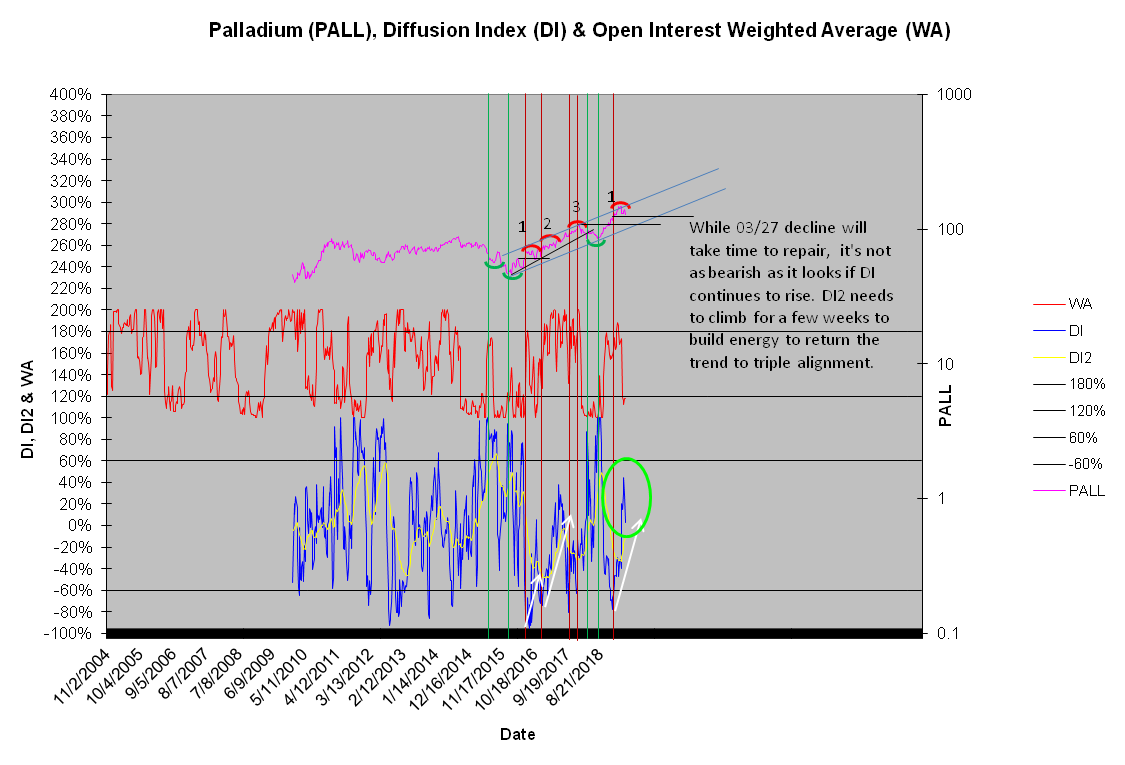

Palladium has been reeling since the panic decline in late March. Palladium's output in the Matrix is blank, an indication of consolidation, because the three-time frames are Down, Up, Up. While some view palladium as a hard sell, they clearly don't recognize the relatively young upside alignment in the secondary and primary trend. Palladium's primary trend is only 10 months old. It's BuST = -0.58 tells that the impulse has yet to reach its mean alignment. This doesn't mean primary trend alignment can't fail (it might). Assuming it will at this stage is undisciplined trading.

The distribution of leverage also reflects accumulation similar to that from 2016 to 2017 (see Palladium DI). This accumulation took place after two blocking domes formed after the initial rally from the 2016 low; these domes have been marked 1, 2, and 3. Accumulation from mid-2016 to early 2017 drove DI and DI2 higher while 'optimism' was flushed out. Subscribers might be saying, but the DI didn't generate another bullish setup. Sometimes the selling is not strong enough to generated DI > 60%, a signal of extreme distribution in the futures and options markets. Less concentration selling, however, can offer the same effect if it takes place over a long enough period. Here lies the value of DI2. A slow steady climb of DI2 toward or above 0 represents enough energy to restart upside alignment in the primary trend - a trend that currently exists in palladium. The question we should be asking is whether or not the most recent blocking dome (marked 1) will acquire enough energy to restart triple. I can't say it will, but it's happened before, especially when the primary trend remains in upside alignment.

Palladium DI