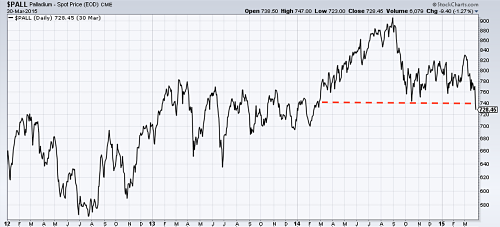

Precious metals keep falling. We pointed out in October that the outlook for the precious basket of metals was bearish and that palladium was the only one holding its value. Today, the picture looks even more bearish.

Gold and silver are near their lowest levels, platinum recently made a 5-year low and palladium, the only metal that was showing some hope is now falling and marking a 1-year low.

CME Group (NASDAQ:CME) palladium price since 2012. Source: MetalMiner

Although last year we were bullish on Palladium, the picture is starting to look like a downward trend. The precious metal is now breaking a key support level after hitting deeper lows. This indicates that selling pressure is increasing as the metal declines, and its lower high points are a sign that there is diminishing buying pressure during those upward bounces.

The Palladium Pullback

The erosion of palladium’s fundamental strength has been so weak that palladium-backed exchange-traded funds saw their biggest weekly outflows (more than 50,000 ounces) since August last week.

Palladium posted strong gains in the first half of 2014 bolstered by labor strife in major producer nation South Africa. Even after a strike that hit all producers ended a supply deficit and demand growth in the light vehicle sector helped to prices continue to rise. Interestingly, increasing demand and falling supply is expected for the next few years despite what we’ve seen from prices recently.

HSBC forecasts demand from the auto sector to increase at a compound rate of 3.7% for the next 3 years. The bank is predicting continued deficits for palladium with rising prices as a result. The estimate for 2015 is $837 per ounce rising to $900 per ounce for 2016-17.

The HSBC (LONDON:HSBA) Estimate

Is this, in a word, a good estimate?

Well, while we don’t argue that the bank might not be making a solid supply/demand analysis, we do argue how prices will actually react. The problem is that the bank is making a forecast based solely on the supply/demand balance of a specific metal, forgetting about the bigger picture.

A bearish commodity environment, a strong dollar and low oil prices are punishing palladium prices as well as the rest of precious metals. Despite the apparent positive palladium fundamentals, the big picture better change or the bank will see its price forecast come in way off from reality.