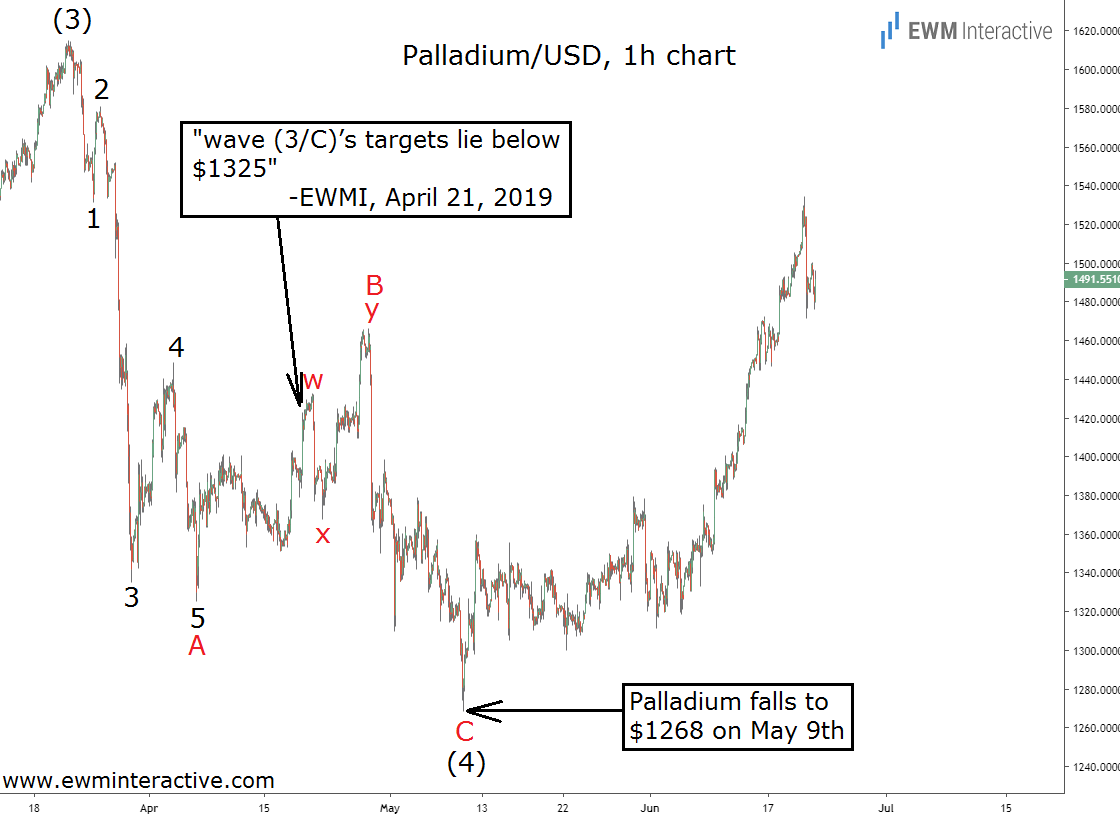

Two months ago, the price of palladium was hovering around $1425 following a recovery from as low as $1325. Unfortunately for the bulls, the structure of the decline from $1615 to $1325 suggested still lower targets were plausible. The chart below, published on April 21st, visualizes the reason for our pessimism.

The hourly chart of palladium revealed a five-wave impulse to the south from $1615 to $1325. According to the Elliott wave theory, once the corresponding three-wave recovery in wave (2/B) was over, another selloff in wave (3/C) was supposed to follow.

Instead of joining the bulls near $1425 two months ago, we thought it was time for caution. How far the anticipated decline was going to go was unknown, but initial targets below the bottom of wave (1/A) made sense. Then this happened:

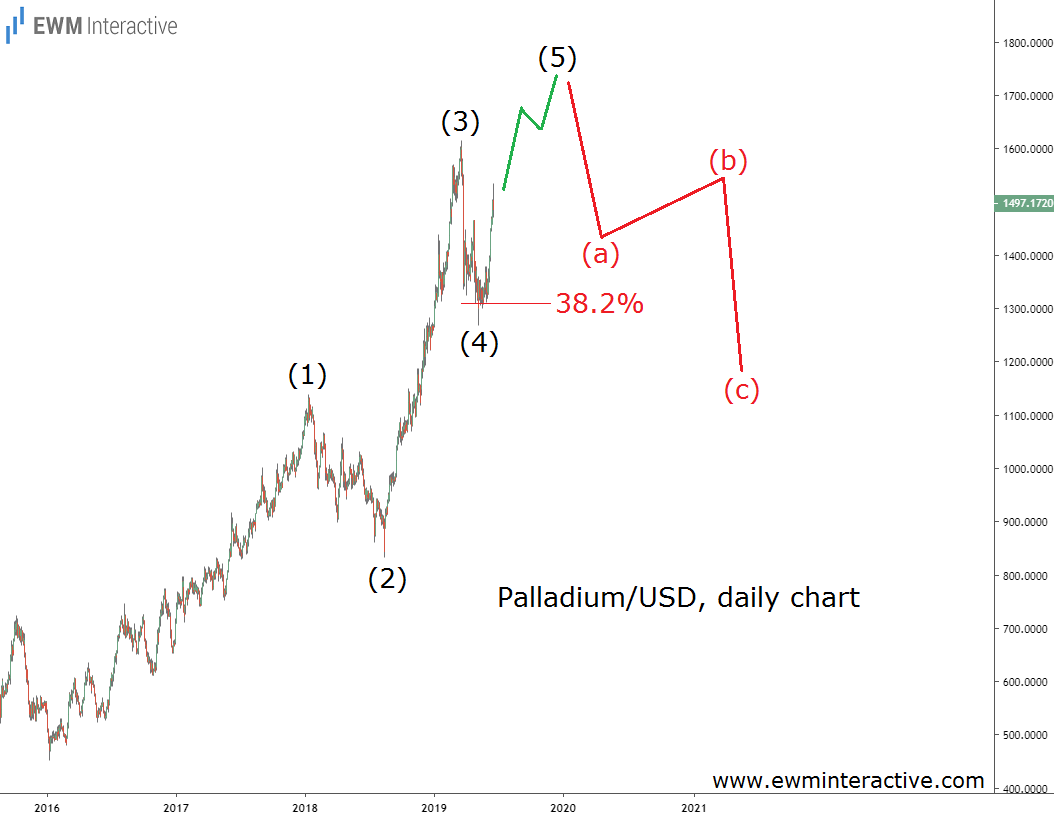

On May 9th, the price of palladium fell to $1268, down 11% in less than 20 days. The following rebound to $1535 so far means the pullback between $1614 and $1268 is a simple A-B-C zigzag. In order to see where it fits in the bigger picture, we have to take a look at the daily chart below.

The daily chart shows that the entire rally from $453 in January 2016 is a five-wave impulse in progress. Wave (1) up to $1139 was followed by a pullback in wave (2) down to $833. Wave (3) traveled all the way up to $1615, before the bulls returned in wave (4) to $1268.

Palladium Poised for a Bearish Reversal

The fact that wave (4) found support near the 38.2% Fibonacci level, further reinforces our belief that the current surge is part of wave (5) up. Wave (5) is supposed to exceed the top of wave (3). If this count is correct, we can expect a new high very soon. Once there, things will get very interesting.

A 260%+ rally in less than four years can convince palladium investors the uptrend is going to go on indefinitely. Alas, no trend lasts forever and palladium’s is unlikely to be the first to do so. A three-wave correction in the opposite direction follows every impulse. In XPD/USD ‘s case, once wave (5) completes the pattern, a notable decline back down to ~$1200 can be expected.