Palladium is not usually given as much attention as gold, silver or platinum is commonly accorded, but perhaps that should change. A number of reasons are conspiring in favor of the metal’s buy position. To understand this, we are going to see both the demand and supply factors. Supply of palladium consists of two main sources: mining and recycling. Demand consists of auto catalyst, industrial uses, jewellery and investment purposes.

Over three quarters of palladium’s mining supply comes from two countries: Russia and South Africa. Russia’s key producer’s, NORILSK, has seen its production drop 2 percent from 2014 to 2015, according to their latest production results. NORILSK has no immediate plans to increase production and is experiencing declining ore grades. South African production has experienced shaft closures and postponed or slashed capital spending. Overall, Statista’s data shows that South Africa’s palladium production dropped by 11.2 percent from 2010 to 2015. Russia’s production has fallen by 5.5 percent over the same period. Keeping in mind capital spending cuts and shaft closures, the fall in production appears to continue or remain flat until at least 2017.

Recycling or recovery sector of palladium would continue to play an increasingly important role in the metal’s supply as vehicles with high palladium loadings manufactured in the late 1990s and early 2000s make their way to recycling companies. The importance of recycling is espoused by the growth from providing 5.8 percent of overall supply in 2004 to 31.1 and 28.1 percent in 2014 and 2015 respectively.

Considering the expected flat growth of production, recovery would provide an even larger supply of palladium. However, as noted by John Matthey’s November 2015 report on the matter, recovery inventory increased as prices fell throughout 2015. This appears to show that the recovery sectors seem to loathe selling during low prices. The report also predicts a 7 percent rise in recovery input in the market.

The biggest demand component of demand for palladium is for auto catalyst purposes. This amounts to between 70 and 80 percent of the total demand. With ongoing implementation of Euro 6b legislation, all diesel passenger cars are expected to be fully compliant with regulations. By September 2016, all light commercial vehicles would also fall under the purview of the legislation. While a reduction of palladium loadings in the platinum palladium ratio within the diesel catalyst mix is expected due to increased efficiency emissions requirements, the reduction should be not fatal enough to considerably affect demand negatively.

Platinum is favored because it is a higher efficient catalyst compared to palladium, but cost constraints encourage a combination of the two. However, according to John Matthey’s report, 85 percent of auto catalyst demand arises from light duty gasoline vehicles. Growth in this segment in all major markets has been strong and is expected to continue that way. Palladium use in this segment is especially high.

According to Statista, global motor vehicle production is expected to grow strongly, led by North America (the biggest market for palladium) and followed by China. The North American vehicle market is driven by cheap oil and a growing (albeit still weak) economy in comparison to other major developed economies. China’s production is also growing on the basis of the cheap oil, and we are seeing car sales, especially for SUVs, growing rapidly. In fact, a look at monthly Chinese automobile production data shows that strong growth was experienced from the low in July 2015 to December the same year. While a drop in production was experienced in January 2016, this was largely expected and will be temporary.

However, it appears that market concerns over the continuing fast growth of China’s economy are coming to an end. While growth fears are true, the new normal growth should set in quickly as growth stabilizes in export markets such as the US and Europe. A deceleration of the drop in GDP growth is expected and this should offer a confirmatory aspect to the continued expected increase in auto demand and production. This deceleration expectation is grounded, partly because the market appears not to be watching logistics in China.

The transport sector tends to foreshadow the overall economy in most economies. China is no exception. The China Logistics Prosperity Index has been indicating a steady increase in activity and confidence in the transport sector. Improvement has been seen consistently over the last few months across 10 of the 12 sub-indices. Operating profit and logistics service charges are still depressed with operating costs rising, but the two indicators are experiencing the depression in deceleration consistently. New orders and business volume indicators are strongly up as well as increased capacity utilization and investment in fixed assets. Employment in the sector is up as well as business expectations. China should be the final boost the market needs to add confidence in demand expectations and as prognosticated by the logistics sector, we should see GDP figures and the market swing favorably for a big long position.

US emissions legislation is entering a new phase of implementation for both LEV and Tier 3 regulations. Increased uptake of gasoline loadings is expected due to positively impacted palladium demand. The demand situation should be augmented with a flat expectation for overall industrial demand, as the chemicals industry strongly demands palladium, but dental and electronic sectors continue substituting palladium with base metals in their applications.

In summary, mining supply is expected to remain flat, if not decrease, while recovery supplies should increase fairly. Auto catalyst demand should rise, strongly buoyed by increased emissions requirements and production in North America, Europe and China. Industrial demand should remain flat. Essentially when one thinks about it in figures, the overall picture is of 70 percent of the demand component (auto catalyst) being supplied by 30 percent of the supply component (recovery supplies).

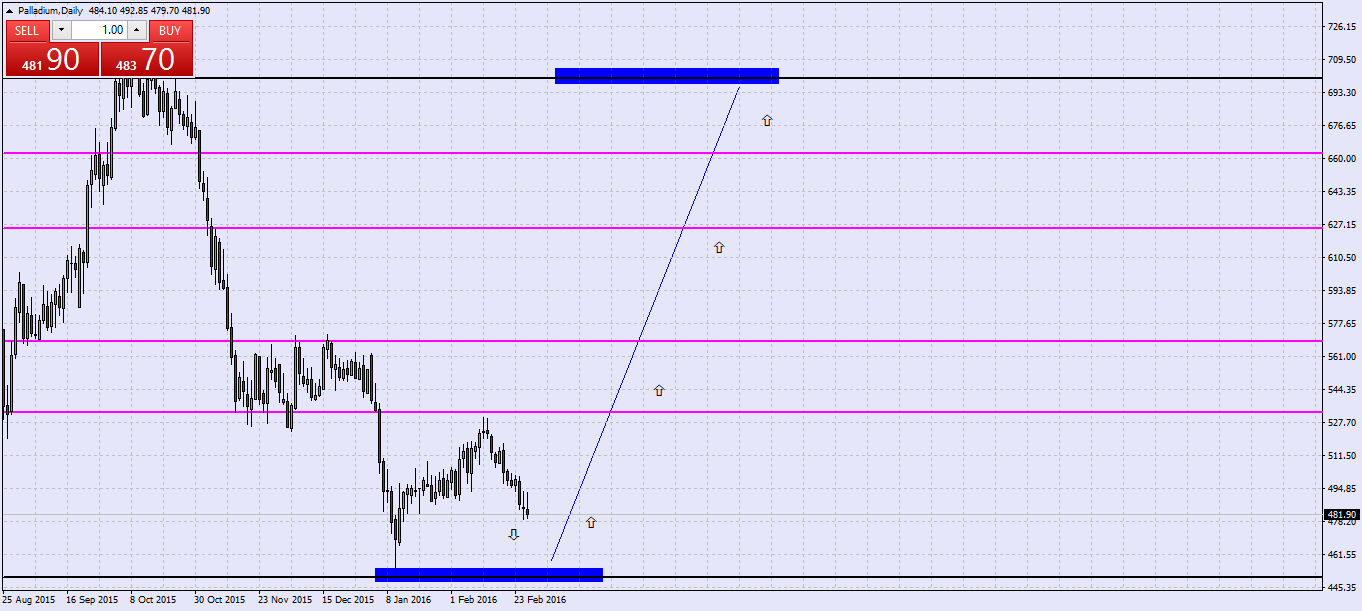

From a technical chart perspective, the daily chart below shows a waning up move that entices the possibility of a down move. With the fundamentals at play, the down move should exhaust at the $450 zone, hence forming a double bottom. The formation is consistent with the end of trend and a change of direction. The $450 zone would be the point of validity below which the trade becomes invalid (see chart below). The up move should reach the $700 zone - the take profit point - but scope for further move may exist. The move is expected to unfold over 2016 to mid-2017 when capital expenditures from mining companies begin to take shape and satisfy increased demand.