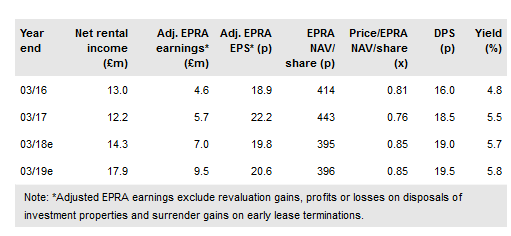

Palace Capital PLC (LON:PCA) has announced its interim results for the six months ended 30 September 2017. These show good progress in income, earnings, and NAV. The interim dividend had been previously announced, showing growth of 5.6% to 9.5p per share. The significant acquisition of the RT Warren portfolio and accompanying capital increase came after the period under review and is not reflected in the results. Our forecasts reflect the near-term dilution from the acquisition but not the upside from asset management, due to uncertainty as to the timing and impact. Despite that, Palace offers a highly attractive yield and discount to NAV, while the increased market capitalisation and intention to seek a Main Market listing are likely to broaden Palace’s appeal to a wider investor base.

Interim progress; yet to reflect RT Warren

Management remains very positive about prospects for Palace. While occupier and investor demand for commercial property outside of Central London remains good, the company cites progress with some of its strategic assets and the prospective upside from asset management of the recently acquired RT Warren assets. These have increased Palace’s asset base by 35% since end-H118 but the potential is clear in the smaller immediate income uplift of c 26%. Management plans to increase income from the commercial assets acquired and recycle capital from the lower-yielding residential assets into further commercial investment.

To read the entire report Please click on the pdf File Below: