The year ended 31 March 2018 was one of significant development and growth for Palace Capital PLC (LON:PCA), including the £68m acquisition of RT Warren, its largest acquisition to date, a £70m capital raise, and a move to trading on the Main Market of the LSE. The shares will join the FTSE SmallCap Index and FTSE All-Share on 18 June. The portfolio, enlarged by the RT Warren acquisition, offers significant asset management opportunities, while management seeks further accretive acquisitions, neither of which is reflected in our estimates. The shares offer an attractive yield and trade at a significant discount to NAV.

FY18 earnings and NAV ahead of our forecasts

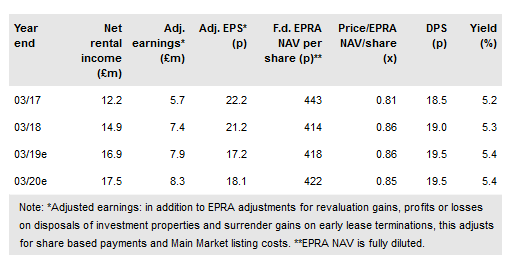

Net rental income increased by 22% to £14.9m, with RT Warren consolidated for a little under six months. Contracted net rents of £16.8m at end FY18 point to further rent growth before the impact of leasing. Adjusted earnings, which exclude c £700k of one-off Main Market listing costs, increased 30% to £7.4m, ahead of our £7.0m forecast, and significantly offset the 36% increase in average share count. Adjusted EPS was 21.2p (FY17: 22.2p), providing 1.1x cover of the increased DPS of 19.0p (FY17: 18.5p). Diluted EPRA NAV per share of 414p benefited from valuation gains, and while it was lower y-o-y as a result of the dilution related to the capital raise, it was ahead of our forecast of 395p, LTV reduced to 30% (FY17: 37%), with cash and unutilized debt facilities providing headroom for accretive acquisitions.

To read the entire report Please click on the pdf File Below: