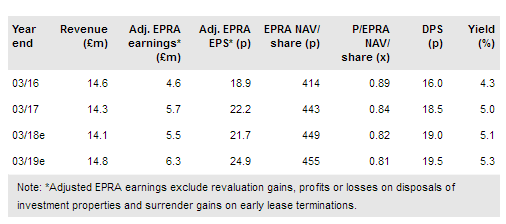

Palace Capital PLC (LON:PCA) has completed the previously announced £20m acquisition via a corporate deal, more than replacing rental income from disposals made in FY17. The new assets are fully let at a higher yield than our previous estimates. This leads us to raise our forecasts slightly and provides scope for rental and valuation uplifts in future, in line with Palace’s strategy of providing capital growth as well as stable income.

High-quality assets at an attractive price

The company Palace has acquired owns a mixed-use, modern, office, residential, hotel and retail development in central Newcastle, with two floors of a multi-storey car park as well. The new assets’ annual rental income of £1.765m represents a net initial yield of 8.6% on the £20m acquisition price after costs, which compares well with the rest of the portfolio at c 7.5% on average. It is expected that the next speculative office development in Newcastle will not be ready for two years, and occupier demand has been strong in recent months – favourable dynamics for rental markets in the area.

To read the entire report Please click on the pdf File Below: