Investing.com’s stocks of the week

Assuming a successful FDA review of remimazolam for procedural sedation (PS), with an outcome due by 5 April 2020, Paion O.N (DE:PA8G) is set for 20–25% royalties from US sales made by Cosmo. Remimazolam is a safe ultra-short-acting sedative/anaesthetic offering both rapid onset and offset of action. This profile should drive US market uptake for short, painful procedures such as colonoscopy. A European regulatory filing for PS will now be made in H219 allowing a possible European launch in 2021, an abbreviated EMA filing for general anaesthesia (GA) could be made by late 2020. We maintain our valuation of €317m (€4.96 per share).

US outcome by 5 April 2020, EU review by end Q420

The FDA review will complete by 5 April 2020 (PDUFA), which could allow an H2 2020 launch of remimazolam. Four Phase III studies in the US and Japan all met their primary endpoints and reported favourable safety data, so we use a 90% likelihood of approval. Paion now plans to file with the EMA for PS (based on the US trials) by late 2019 (and subject to EMA approval of the Paediatric Investigation Plan), potentially allowing EU sales from 2021. Recruitment to the GA Phase III (NCT03661489) is ongoing, with over 200 of 500 planned patients treated since July 2018; completion may now be in Q120 if recruitment accelerates. The Phase III data in GA could then allow a faster abbreviated follow-on filing.

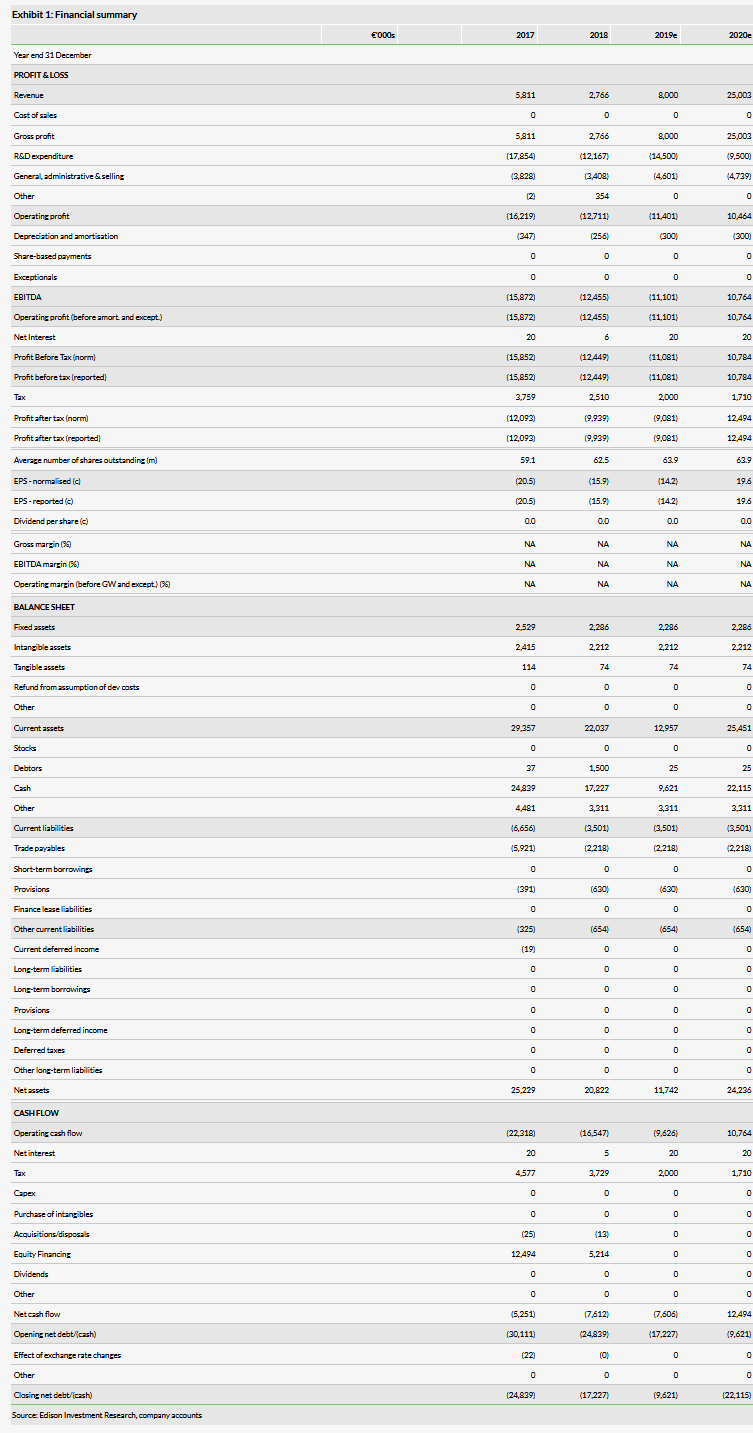

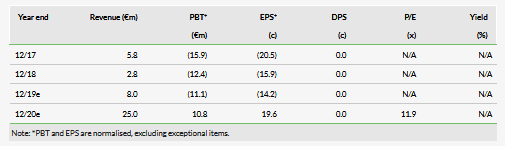

H119 results show improved cash position

Paion received an H1 €7.5m milestone from Cosmo on the FDA regulatory filing, a further €0.5m related to the Japanese filing might be received in H2. In H219, UK R&D tax credits should provide €2m in cash. The company expects a reported PAT loss for FY19 of €7–10m compared to our forecast loss of €9.1m, formerly €9.3m. Our forecast revenues for 2020 (€25m) come from milestones in the US, Japan and Canada. Depending on the US and Japanese launch dates and sales growth, there might be additional royalties, but these really grow from 2021. Given the €19.2m June 19 cash plus expected income, Paion is funded into H220. Management states that a further €10m of funding will be required up to the GA EMA filing (we estimate Q420). Paion now has a European Investment Bank loan facility of €20m available until June 2021; €5m will be drawn in H219. Paion intends to market remimazolam directly in some countries in Europe but this will need investment.

Valuation: Retained at €317m

We expect the higher patient throughput achievable with remimazolam in PS procedures such as colonoscopy to be a key factor driving US market uptake from late 2020. We retain our valuation of €317m or €4.96/share. Use of the European Investment Bank loan of €20m will reduce the potential dilution requirement.

Business description

Paion is an emerging specialty pharma company developing anaesthesia products. Lead product remimazolam has been filed for approval in the US, Japan and China and is partnered with Cosmo (US), Mundipharma (Japan), Yichang (China), Hana Pharma (South Korea), Pharmascience (Canada) and R-Pharm (CIS, Turkey, MENA).