Paion (PA.DE) has started a 90-patient Phase II study for its sedative remimazolam in general anaesthesia. Remimazolam has potential as an alternative to standard propofol because of its favourable side effect profile. In Japan, partner Ono Pharmaceutical is expecting Phase II/III anaesthesia data in Q114 needed for the European data package; however, Ono has stopped the Phase II ICU trial. We have maintained our valuation at €56m.

German general anaesthesia trial

Paion has started a Phase II trial of GABAA receptor agonist remimazolam in its lead European indication, general anaesthesia, following approval from the German regulator. Paion will finance the six-month trial at a cost of €2-4m, although it is in discussions to find a partner for a pivotal European Phase III trial. Remimazolam has potential to meet the need for new anaesthetics with rapid onset/offset, but that have lower risk of cardiopulmonary events than the standard of care propofol.

Ono’s anaesthesia readout due Q114, ICU on hold

Paion’s Japanese partner Ono has halted its Phase II trial of remimazolam in ICU sedation due to the unclear pharmacokinetic (PK) result in long-term administration. Ono will carry out pre-clinical studies and PK modelling to determine if dose adjustment is needed for further trials. However, the data from Ono’s Phase II/III trial in general anaesthesia is due in Q114 and will be used to support EU and US partnering discussions. The Japanese launch in general anaesthesia is set for 2015.

H113 financials and cash outlook

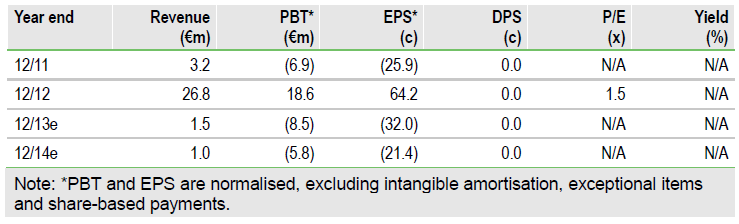

H113 income of €1.5m comprised €1.2m from Yichang for the technology transfer of remimazolam and a €300k option fee from the agreement with Hana Pharma. After repayment of a net €7m loan, Q213 cash and equivalents stood at €14.2m. We forecast that Paion is funded into Q115, including the cost of the Phase II study.

Valuation: Maintained at €56m

We maintain our DCF valuation at €56m, including €37m for remimazolam, €14m of H113 cash and €4m for the GGF2 with Acorda. We have made minor adjustments to short-term costs based on company guidance. The shares have risen c 45% over the past month but near-term data on remimazolam could serve as new catalysts.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Paion European Phase II Underway

European Phase II underway

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.