The S&P 500 joined the Dow in record high territory Monday and it seems like we should celebrate. Let’s paint the town green! And while we are doing it, lets use some products from PPG Industries (PPG). They do make paint, among other things, and come to think of it this is a large cap company at over 27 billion and those companies are in favor now right? Maybe we should look at the technical set up too before we have too many beverages.

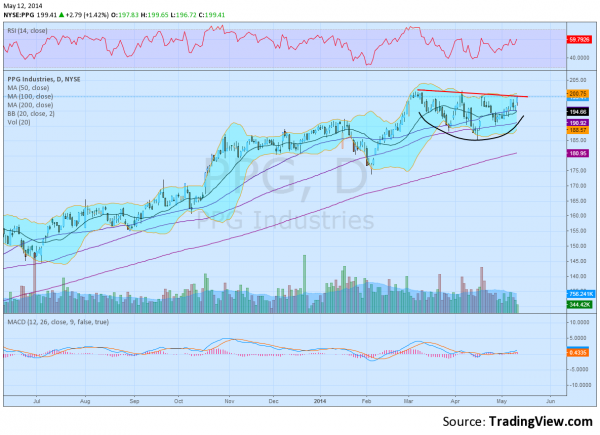

The daily chart above shows the last 12 months of a steady rise from October 2011. Price is now testing the upper resistance of the cup like consolidation over the last 2 and a half months. The momentum set up is favorable with the RSI tightening on 60 and the MACD rising. A break of that resistance higher would give a target of 215 to the upside. The recent history suggests protecting against the 190 area. Point and Figure traders might be concerned as the 3-box reversal chart using the Average True Range (ATR) for box size gives a price objective lower to 169. But if you get your hands dirty a print of 201.50 or higher will change that to a triple top break out with a new price objective of 217.75. This defines your trade.

Disclaimer: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.