We issued an updated report on Pacira Pharmaceuticals, Inc. (NASDAQ:PCRX) on Aug 11.

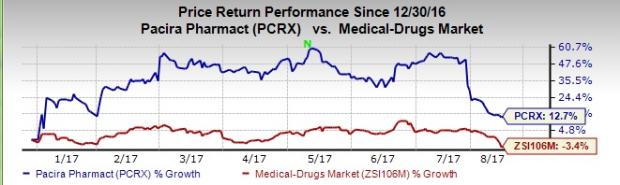

In fact, shares of the company have rallied 12.7% against the Zacks classified industry’s fall 3.4% on a year-to-date basis.

Pacira Pharmaceuticals, Inc. is a specialty pharmaceutical company focused on the development, commercialization and manufacture of proprietary pharmaceutical products primarily for use in hospitals and ambulatory surgery centers.

Notably, the company’s flagship product, Exparel, was launched in 2012. This product is a liposome injection of bupivacaine, which is indicated for single-dose administration into the surgical site to produce postsurgical analgesia. In January 2017, Pacira inked a co-promotion agreement with DePuy Synthes Sales Inc. to market and promote the use of Exparel for orthopedic procedures in the U.S. market. We expect this collaboration to significantly expand use of Exparel across a broad range of surgical procedures.

In fact, this Parsippany, NJ-based company’s efforts to expand Exparel's label to boost sales in oral surgery and chronic pain are encouraging.

In September 2016, the company had launched Exparel to the oral surgeon community to treat pain following oral and maxillofacial procedures.

Currently, it expects that a label expansion of this injection into oral surgery might benefit oral and maxillofacial surgeons, prosthodontists and endodontists by giving them the ability to produce analgesia with a single-dose administration during the days following surgery.

Prior to this, in April 2016, the company had initiated a randomized controlled study on Exparel for total knee arthroplasty (TKA). In March 2017, the company announced positive topline data from this study.

Additionally, Pacira is conducting a phase IV study of Exparel in spinal fusion surgery with results expected in the fourth quarter of 2017. Also, it is launching a series of phase IV studies in soft tissue procedures. These studies will assess the company’s flagship product as part of its multimodal protocol for C-section, colon cancer and breast reconstruction surgery.

Meanwhile, Pacira remains on track to resubmit its supplemental new drug application (sNDA), to the FDA later in 2017. This, in turn, will seek expansion of the Exparel label to include the indication of administration via nerve block. The sNDA will be based on two pivotal efficacy studies.

Furthermore, the company announced positive top-line data from these studies in July 2017. The company believes that the data from these two studies will meet the requirements of the FDA as stated in the complete response letter (issued in March 2015).

In January, Pacira signed an agreement with DePuy Synthes Sales Inc. (a subsidiary of Johnson & Johnson (NYSE:JNJ) ) to market and promote the use of Exparelfor orthopedic procedures in the U.S. market.

However, Pacira’s drug, DepoCyt(e)’s sales have been declining. The downturn was almost 59.4% in the first half of 2017 compared with the year-ago quarter. The company also announced that it will discontinue the production of DepoCyt(e) due to persistent technical issues specific to DepoCyt.

Hence, it is heavily dependent on Exparel for growth, which accounts for a significant chunk of its revenues. Hence, a decline in Exparel sales will adversely impact the company's top line.

Zacks Rank & Stocks to Consider

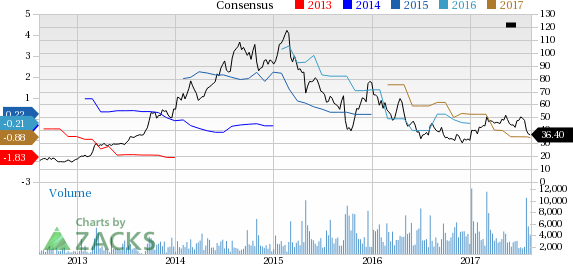

Pacira currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in health care sector include Enzo Biochem, Inc. (NYSE:ENZ) and Sanofi (NYSE:SNY) . While Enzo Biochem sports a Zacks Rank #1 (Strong Buy), Sanofi holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Enzo Biochem’s loss per share estimates narrowed from 12 cents to 7 cents for 2017 and from 11 cents to 3 cents for 2018 over the last 60 days. The company delivered positive earnings surprises in all the trailing four quarters, with an average beat of 55.83%. The share price of the company has increased 59.3% year to date.

Sanofi’s earnings per share estimates increased from $3.21 to $3.31 for 2017 and from $3.36 to $3.38 for 2018 over last 30 days. The company pulled off positive earnings surprises in three of the trailing four quarters, with an average beat of 5.10%. The share price of the company has increased 17.6% year to date.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course. Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

Sanofi (SNY): Free Stock Analysis Report

Johnson & Johnson (JNJ): Free Stock Analysis Report

Enzo Biochem, Inc. (ENZ): Free Stock Analysis Report

Pacira Pharmaceuticals, Inc. (PCRX): Free Stock Analysis Report

Original post

Zacks Investment Research