PACCAR Inc.’s (NASDAQ:PCAR) second-quarter 2017 earnings were $1.06 per share down from $1.37 recorded in the year-ago quarter. Earnings surpassed the Zacks Consensus Estimate of 99 cents. Results benefited from rising truck production in North America, a strong European market and global higher market sales.

Net sales and financial services revenues increased to $4.7 million from $4.41 million recorded in second-quarter 2016. Thus revenues in this reported quarter topped the Zacks Consensus Estimate of $4.27 billion.

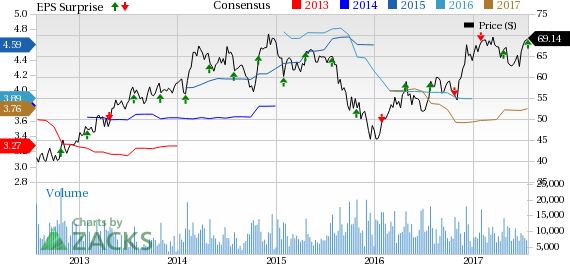

PACCAR Inc. Price, Consensus and EPS Surprise

Segment Results

Revenues from the Truck, Parts and Other segment increased to $4.4 billion in second-quarter 2017 from $4.12 billion in the year-ago quarter. The segment’s pre-tax income declined to $467.3 million, in comparison to a gain of $562.5million, recorded a year-ago.

Revenues in the Financial Services segment (comprising a portfolio of 180,000 trucks and trailers, with total assets of $12.69 billion) rose to $306.3 million. Pre-tax income in the segment declined to $63 million from $77.3 million in the year-ago quarter.

Financial Position

PACCAR’s cash and marketable debt securities amounted to $3 billion as of Jun 30, 2017 compared with $2.9 billion as of Dec 31, 2016.

Guidance

PACCAR increased sales expectations in the above 16-ton truck market in Europe to 290,000-310,000 units from the previous guidance of 270,000−300,000 units, for 2017.

The company also increased the Class 8 industry retail sales estimates in the U.S. and Canada, to be within 200,000-220,000 compared with the previous expectation of 190,000-220,000 vehicles, for 2017.

Zacks Rank & Key Picks

PACCAR currently carries a Zacks Rank #2 (Buy).

Some other companies worth considering in the auto space are Volkswagen (DE:VOWG_p) AG (OTC:VLKAY) , Daimler AG (OTC:DDAIF) and Cummins Inc. (NYSE:CMI) . Both Volkswagen and Daimler sport a Zacks Rank #1 (Strong Buy), whereas Cummins carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

Volkswagen has expected long-term growth of 17.3%.

Daimler has expected long-term growth of 2.8%.

Cummins has expected long-term growth of 11.4%.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

PACCAR Inc. (PCAR): Free Stock Analysis Report

Daimler AG (DDAIF): Free Stock Analysis Report

Volkswagen AG (VLKAY): Free Stock Analysis Report

Cummins Inc. (CMI): Free Stock Analysis Report

Original post

Zacks Investment Research