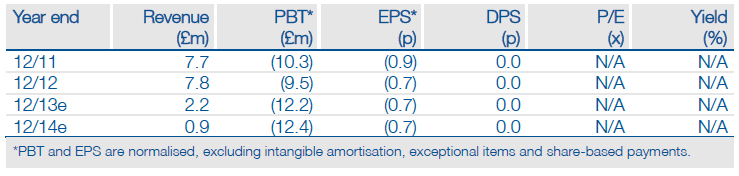

Oxford BioMedica’s (OXB.L) investment case is geared to the striking of worthwhile commercial partnerships for its late-stage clinical assets. The next key inflection point is whether Sanofi decides to opt-in for the further development of RetinoStat, a gene-based treatment for “wet” AMD (age-related macular degeneration). A positive outcome would help validate the LentiVector platform and could kick-start additional collaborations. We currently value the company at £58.5m (down from £62.5m).

RetinoStat opt-in by Sanofi is keenly awaited

Oxford BioMedica is essentially a bet on the merits of gene therapy in general and the LentiVector delivery platform in particular. The approach is promising; particularly in ophthalmology indications where a single administration could safely provide a sustained (or even permanent) effect. Having opted-in for two smaller ocular projects, Sanofi’s decision on RetinoStat could be the defining moment for Oxford BioMedica.

Collaborations have been slow

Oxford BioMedica has endured a difficult period, especially as collaboration discussions failed to conclude, yet gene-based medicines offer the prospect of dramatically altering the outcomes of a number of devastating diseases. The recent (November 2012) European approval of UniQure’s Glybera marks a pivotal point for gene therapy, effectively mapping a regulatory pathway. Meanwhile, Oxford BioMedica has successfully de-risked several critical aspects of the process, especially production.

Currently financed through to early-2014

Net cash was reported as £14.1m at the end-2012, which with forecast FY13 R&D (net) spend of £11.3m and underlying G&A expenditure of £3.3m, suggests the current cash runway extends through to early-2014. Were Sanofi to opt-in to RetinoStat (a decision is expected before Q114), we estimate a $20m milestone payment would be triggered, so extending the runway to around mid-2015. Further income could arise from manufacturing revenues and other partnering milestones (eg around $1-2m from Pfizer for the clinical start for the anti-5T4 antibody project).

Valuation: Pipeline alone supports a £58.5m value

Clearly much depends of the successful development of the ocular programmes (in collaboration with Sanofi). Our valuation of £58.5m, down from our previous £62.5m, is based on an rNPV model of the late-stage pipeline alone. We have conservatively chosen not to include the value of other less visible, but arguably just as important, assets such as the manufacturing facility and intellectual property estate.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Oxford BioMedica: Financed Through To Early 2014

Published 03/05/2013, 06:37 AM

Updated 07/09/2023, 06:31 AM

Oxford BioMedica: Financed Through To Early 2014

Look no further...

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.