With a probable approval for Novartis’s CTL019 (tisagenlecleucel) (OXB manufacture a key component) in both paediatric ALL and DLBCL on the horizon, Oxford Biomedica (LON:OXB) is in position to crystallise a potentially significant revenue stream. Building on the original 2014 agreement with Novartis, the new commercial supply agreement for CTL019 includes $10m upfront and in excess of $90m in additional revenue over the next three years.

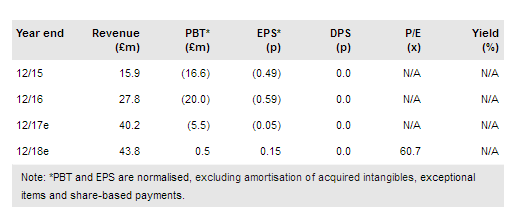

Additionally, the company has refinanced its Oberland facility with Oaktree Capital Management to the tune of $55m (c $10m undrawn) on improved terms. Our valuation has increased to £251.6m (8.15p/share) vs £208.5m (6.75p/share), mainly as a result of updating CTL019 assumptions.

CTL019 ad-com unanimous but cautious on safety

Novartis has filed its lead CAR-T CTL019 (OXB manufacture a key component) with the FDA for approval in paediatric ALL patients. At the FDA advisory committee (ad-com) on 12 July, CTL019 was reviewed by independent experts and unanimously recommended for approval; while multiple concerns were raised with regard to its long-term safety, we believe approval later this year is likely (PDUFA date: 3 October). We anticipate launch in the US and Europe for paediatric ALL by the year end.

To read the entire report please click on the pdf file below: