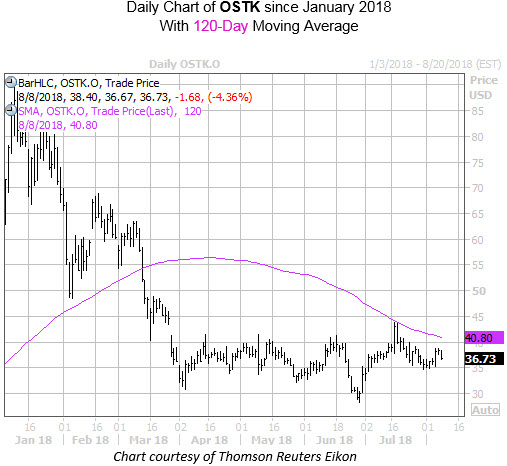

Online discount warehouse Overstock.com Inc (NASDAQ:OSTK) is gearing up to report second-quarter earnings after the market closes tomorrow, Aug. 9. Last seen trading 4% lower at $36.73, Overstock shares have been moving sideways on the charts since late March, stuck between the $30-$40 levels. OSTK's mid-July breakout attempt was quickly capped by the 120-day moving average, and year-to-date the stock is sporting a 42% deficit. Below, we will take a look at what the options market has priced in for the the stock's post-earnings move.

Looking at OSTK's earnings history, the stock has closed higher or flat the day after the company reports in six of the last eight quarters, including a 30.7% surge in November. Looking back eight quarters, the shares have moved 9.3% the day after earnings, on average, regardless of direction. This time around, the options market is pricing in a 22% move for Friday's trading.

Digging into options, Overstock's Schaeffer's put/call open interest ratio (SOIR) of 0.32 ranks in the low 12th annual percentile. This SOIR reveals that calls outnumber puts by a wider-than-usual margin among options set to expire within three months. Looking closer, the weekly 8/10 40-strike call saw the largest increase in open interest in the past 10 session.

Plus, the online retail concern has been a good purchase for premium buyers during the past 12 months. That's per OSTK's Schaeffer's Volatility Scorecard (SVS) of 85 out of 100, which shows the stock has tended to make much bigger-than-expected moves on the charts compared to what the options market was expecting.