The following are the intraday outlooks for EUR/USD, USD/JPY, AUD/NZD, and Spot Gold as provided by the technical strategy team at SEB Group.

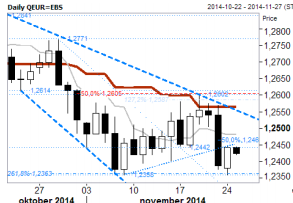

EUR/USD: Mid-body resistance recheck. The move up neutralized near-term stretched conditions yesterday. The move is primarily seen as a mid-body re-test before down again, but if also scaling 1.2506 this might be an incorrect notion. Current intraday stretches are located at 1.2360 & 1.2485, but already back below 1.2373 would argue for fresh lows. The US GDP & Consumer Confidence releases are main distractions later today.

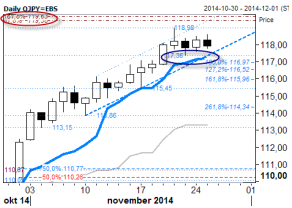

USD/JPY: Forming a short-term top? Trend-following tools remain in bullish gears, but price action has become dubious. A drop below nearby support at 117.36 would add a set at Fibo extension / projection targets at: 116.95, 116.50, 115.95, not ruling out additional losses below those - then with 115.45 & 114.35 in mind. Bearish case likely to misfire on a move back over 118.59. Current intraday stretches are located at 117.20 & 119.00.

AUD/NZD: Ready to break lower. The ongoing consolidation is now running late and a downside break (not only from the triangle but also through the 233d ma band) should be penciled in for the coming day(s). The internal wave pattern of the triangle is currently being completed (max upside should ideally be 1.1001) so the next step should be a downside turn and a break lower. For those subscribing to the idea should sell between 1.0990/1.1000 with a 1.1020 stop.

Gold: Challenging the 55d ma band. The yellow metal continues to show strength as we are holding to the return above the key support (false downside break on the large scale?). Brief attempts to challenge the 55d ma band has also been seen during the past days and as the rejection has become very small it appears as there's very few sellers around. Accordingly the buyers are expected to soon gain the upper hand pushing prices higher.