Snap-on Incorporated (NYSE:SNA) is scheduled to report third-quarter 2017 results, before the opening bell on Oct 19.

Snap-on has an outstanding earnings surprise history — it has not missed estimates in over seven years. Last quarter, the company registered a positive earnings surprise of 2%, generating an average positive surprise of 2.5% for the trailing four quarters.

Let's see how things are shaping up for this announcement and whether Snap-on will be able to maintain its long-standing winning streak.

Factors to Consider

Snap-on’s successful earnings streak highlights its consistent capability to leverage on market opportunities for augmenting growth. Encouragingly, the company has been witnessing robust prospects in most of its business lines which signal brighter days ahead.

Segment wise, Snap-on’s Commercial & Industrial Group has been enjoying strong performance in the European-based hand tools business. It has been benefiting from elevated sales to customers in critical industries, including the military. The segment’s contribution to revenues exceeded estimates by 4.4% and grew 8.5% year over year to $310 million in the second-quarter 2017 results. In the upcoming quarterly results, the Zacks Consensus Estimate for the segment’s sales is pegged at $313 million, reflecting slightly positive sequential growth.

The Repair Systems & Information business has been the company’s strongest growth driver in the recent times, and we expect that higher sales of the diagnostics and repair information products will drive solid organic growth in the quarter under review as well. The Financial Services business is also anticipated to do well. Additionally, the company’s financial services portfolio has been recording steady growth for the past few years.

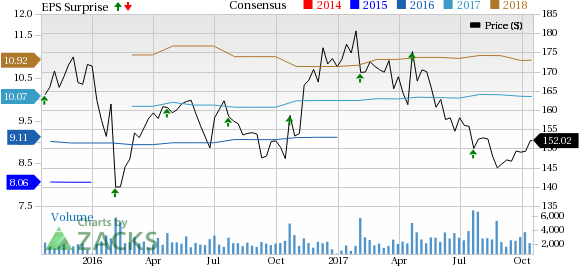

Snap-On Incorporated Price, Consensus and EPS Surprise

Snap-On believes the recent Car-O-Liner buyout will strengthen its Repair Systems & Information Group offering, enabling the company to fortify its footprint in the auto and heavy-duty markets. Snap-On anticipates this company will generate operating income margin comparable to the RS&I undercar equipment business, going forward.

Overall, we expect Snap-on to post $890 million in sales this quarter.

Though Snap-On’s bottom-line performance remained unaffected amid macroeconomic woes, the company is faced with multiple issues that may hurt the third-quarter results. The prevalent softness in industrial markets has significantly impacted client spending, marring the company’s prospects. Also, sluggish oil and gas market activities are likely to thwart the company’s top line in the quarter to be reported.

The Tools Group has also been seeing diminishing sales in the tool storage product line, which has hurt revenues in the recent past. Consequently, we expect the segment to see weak growth sequentially in the to-be-reported quarter.

Further, persistent contraction in capital expenditure by auto dealers and intensifying used car asset quality pressure is a formidable headwind for the company. Year to date, Snap-on’s shares have declined 11.3%, grossly underperforming the industry’s average decline of 2.4%.

Moreover, foreign currency fluctuations pose a major concern as one-third of the company’s revenues are derived from its European businesses. Due to foreign currency woes, in the second quarter, the Commercial & Industrial Group sales declined $4.9 million, Tools Group sales decreased $5 million, and Repair Systems & Information segment witnessed a $3.7-million sales reduction. We believe currency fluctuations will remain a risk to the company’s top line in the quarter under review as well.

Earnings Whispers

Our proven model does not conclusively show that Snap-on will likely beat earnings estimates in this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. This is not the case here as you will see below:

Zacks ESP: Earnings ESP for the company is currently pegged at -0.07%. This is because the Most Accurate estimate is pegged at $2.42, lower than the Zacks Consensus Estimate of $2.43. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: Snap-on has a Zacks Rank #4 (Sell). As it is, we caution against stocks with a Zacks Rank #4 or 5 (Sell rated) going into an earnings announcement, especially when the company is seeing negative estimate revisions.

Stocks That Warrant a Look

Here are some companies that you may want to consider, as our model shows that these have the right combination of elements to post an earnings beat this quarter:

Terex Corporation (NYSE:TEX) , with an Earnings ESP of +4.63% and a Zacks Rank #2, is expected to release quarterly numbers around Oct 30. You can see the complete list of today’s Zacks #1 Rank stocks here.

Scorpio Bulkers Inc. (NYSE:SALT) , with an Earnings ESP of +13.24% and a Zacks Rank #2, is slated to report results on Oct 30.

Rockwell Collins, Inc. (NYSE:COL) , with an Earnings ESP of +6.79% and a Zacks Rank #3, is expected to report quarterly figures around Oct 27.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Scorpio Bulkers Inc. (SALT): Free Stock Analysis Report

Rockwell Collins, Inc. (COL): Free Stock Analysis Report

Terex Corporation (TEX): Free Stock Analysis Report

Snap-On Incorporated (SNA): Free Stock Analysis Report

Original post

Zacks Investment Research