On Thursday, August 16, the main stock market indexes rallied to break out above the confines of their week-long consolidation patterns. Most importantly, the bullish breakout was confirmed by increasing volume in the broad market. Total volume in the Nasdaq surged 27% above the previous day’s level, while turnover in the NYSE rose 17%. Since yesterday’s substantial gains were backed by increasing volume, both the NYSE and Nasdaq registered a bullish “accumulation day” that was indicative of institutional buying activity. Furthermore, it was positive and important that the rally was led by small-cap (Russell 2000) and mid-cap (S&P Midcap 400) growth stocks.

These factors, along with a few proprietary technical signals, caused our rule-based market timing system to shift from “neutral” to “buy.” Nevertheless, until the timing model shifts from “buy” to “confirmed buy” mode, we will continue to operate conservatively and avoid using margin in our model trading portfolio.

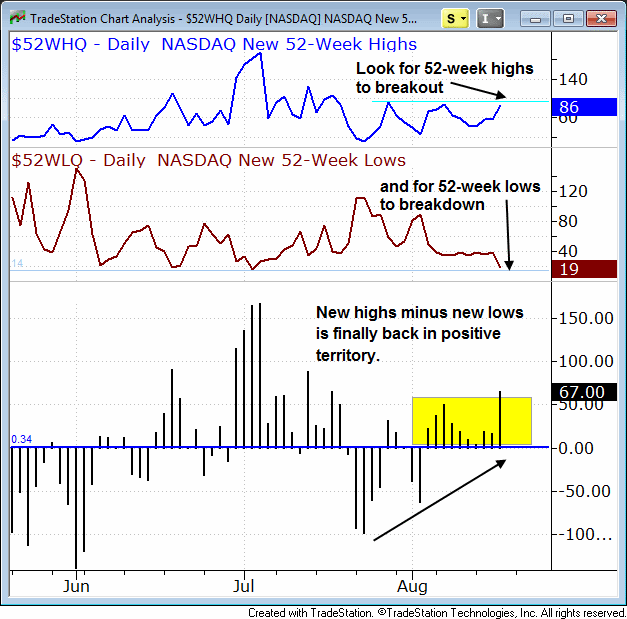

With stocks and ETFs pushing higher, we are now looking for market breadth to expand, which would confirm this market advance. So far, we are beginning to see improving breadth with small-cap growth stocks waking up. Another tool we use to monitor breadth is a simple chart showing the number of stocks making new 52-week highs minus the number of stocks making new 52-week lows. When the difference is firmly positive, and stays that way, it is a confirming signal of improving market breadth. The chart below shows the number of new 52-week highs on the Nasdaq, new 52-week lows on the Nasdaq, and the difference on the bottom:

On the chart above, note that the lines are going in the right direction to indicate an improving bullish trading environment. For the past three weeks, New 52-Week Highs (the blue line) has formed several “higher lows,” and is now poised to breakout above resistance of its prior “swing high.” In non-technical terms, this would simply equate to a surge in the number of stocks jumping to new 52-week highs.

Since stocks and ETFs trading at new 52-week highs have no overhead supply and price resistance of prior highs to hold them down, our most profitable swing trades are frequently in stocks and ETFs trading at 52-week highs (like this CBM trade we closed on August 15 for an 11% gain on a 4-day hold).

Conversely, the New 52-week Lows (burgundy line in the middle) has been setting “lower highs,” and is now poised to break down beneath the summer lows. Overall, we are pleased with current market conditions, but would like to start seeing more powerful breakouts emerging in mass quantities in order to give us the confidence to start aggressively buying leading stocks and ETFs again.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Our Market Timing System Shifts To 'Buy' Mode As Market Breadth Improves

Published 08/19/2012, 02:14 AM

Updated 07/09/2023, 06:31 AM

Our Market Timing System Shifts To 'Buy' Mode As Market Breadth Improves

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.