Quiz: What will cause world oil supply to fall?

- Too little oil in the ground

- Oil prices are too low for oil producers

- Oil prices are too high for oil consumers leading to recession, debt defaults, and ultimately a cut back in credit availability and very low oil prices

- Oil exporters are subject to civil unrest and overthrow of governments, due to low prices and/or depleting reserves

- Lack of money (and physical resources that might be purchased with this money) to pull oil out of the ground.

- Pollution related issues–too much smog in China; too many problems with fracking; too many problems with CO2.

- The financial current system fails, and can only be replaced by one that allows much less debt. Oil prices remain too low under such a system.

In my view, any answer other that the first one is likely to be at least partially right. Ultimately, the issue is that to extract oil or any fossil fuel, we have to keep the financial and political systems together. These systems can be expected to fail, far before we run out of oil in the ground. Most oil in the ground (as well as most other fossil fuels in the ground) will be left in the ground, in my view.

Basing estimates of future oil production on oil reserves is likely to give far too high an indication with respect to actual future production. Even more absurd numbers come from using “resource” numbers (which are higher than reserve numbers) to make estimates of future oil production. Coal and natural gas production is likely to fall at exactly the same time as oil, because the problems are likely to be financial and political ones, not “resources in the ground” problems.

Direct Application of M. King Hubbert Theory is Incorrect

M. King Hubbert is known for his estimates of future oil production (1956, 1962, 1976) based on reserve amounts. There are two things of importance to notice about his estimates:

(a) The oil reserve estimates used are of free flowing oil reserves of the type that geologists currently were looking at. Thus, they were restricted to “cheap to extract” reserves, and

(b) When Hubbert showed graphs of world oil production following a generally symmetric curve (so downslope looks like a mirror image of upslope), Hubbert showed some other source of energy supply (nuclear in his early papers, solar in later ones) rising to high levels, before world oil production ever dropped. He even talked about making liquid fuels using a huge amount of energy plus carbon dioxide and water–in other words, reversing combustion (1962). In order to ramp nuclear or solar up to these very high levels, they would need to be extremely cheap.

The assumptions that M. King Hubbert makes are effectively ones that would allow the economy to continue to grow and the financial system to “hang together.” If a person looks at today’s situation, it is quite different. We do not have an alternate fuel supply that will allow the economy to continue to grow, regardless of fossil fuel consumption. The published reserves include large amounts of oil in the ground that are not of the very cheap to extract type. Extracting such oil will be impossible if oil prices are very low, or if credit availability is lacking. It is tempting for observers to look at oil reserves and assume that all is well, but this is definitely not the case.

Basic issue: Future oil extraction and future substitution is uncertain

One basic issue is the “iffiness” of the reported reserve and resource amounts:

There is lots of oil in the ground, if we can actually get it out. Getting it out requires a combination of a financial system that allows us to do this (high enough prices for producers, adequate credit availability for producers, equity investment available if credit is not available, buyers who can afford the products) and political system that allows this to happen (citizens in countries with oil extraction not rioting for lack of food; banks open in countries trying to import oil; adequate trade connections among countries).

Likewise, substitution is possible among energy products, if it is possible to overcome the many hurdles involved in doing this. There are two cost hurdles: the higher ongoing cost of the substitute and the transition cost. The transition cost gets to be very high if there are a lot of “sunk costs” that are lost–for example, if citizens are forced to quickly change from gasoline powered cars to electric cars, so that the resale value of their gasoline powered cars drops precipitously. There is also a technology hurdle: we need to have the technology to enable using the different energy source.

If the cost of the substitute is higher than the cost of the original energy source, a change to the substitute will tend to make the economy shrink, because wages will “go less far”. If citizens need to pay a whole lot more for new cars, or if electricity is more expensive, citizens will cut back on discretionary expenditures. This cut-back on expenditures will lead to layoffs in discretionary sectors, and will make it more difficult for the government to collect enough tax revenue.

Another basic issue: Wages don’t rise as oil (or energy) prices rise

Economists would like us to believe that we just pay each other’s wages. Wages can rise arbitrarily high independently of actually creating goods and services using energy products.

Unfortunately, this doesn’t seem to be true in practice. Based on my research, in the US high oil prices are associated with flat wages, in inflation-adjusted terms. Wages do not rise as fast as oil prices. Instead, wages tend to rise when oil prices are low, making goods and service affordable.

Part of the problem with rising oil prices is that they radiate through the economy in many ways: in higher food prices, because oil is used to produce and transpire food; in higher metal prices, because oil used in metal production; and in higher finished products, such as automobiles and new homes, because they use oil in their production. With wages not rising sufficiently, as oil prices rise, workers find they need to cutback on discretionary goods. The result is recession and job layoffs. I document this issue in the article Oil Supply Limits and the Continuing Financial Crisis, published in journal Energy in 2012.

The flip side of this issue is that without wages rising as fast as the cost of oil extraction, it is hard for the selling price of oil to rise high enough to provide an adequate profit margin for oil producers. It is inadequate oil prices for oil producers that seem to be the current problem. I talk about this issue in two recent posts: What’s Ahead? Lower Oil Prices, Despite Higher Extraction Costs and Beginning of the End? Oil Companies Cut Back on Spending.

Economists don’t think that prices can remain too low for oil producers. It can happen, because their model of supply and demand is not correct in a world with energy limits. Even if prices temporarily rise again, recession hits again, and we are back to low prices again.

Another basic issue: Diminishing returns

Diminishing returns occurs when it takes more and more energy or other resources to produce the same amount of goods. In the case of oil supply, we reach diminishing returns because companies extract the easy-to-extract oil first. Thus, the price of oil rises because the oil that can be produced cheaply is mostly gone. If we want to obtain more oil, we need to extract the more expensive to extract oil.

One way to see what diminishing returns does is to think about an economy producing two kinds of goods and services:

- The goods and services the consumer really wants–such as food, fresh water, transportation that takes the consumer from door to door, electronic goods, and housing that meets the person’s needs.

- All of the intermediate “stuff” that goes into making the end products in (1).

What happens with diminishing returns is more and more of society’s physical labor and its resources go into intermediate products, leaving less and less to produce end products, and less to actually “grow” the economy. In some sense, it is as if we are becoming less and less efficient at producing final goods and services. In my view, this is a major reason why wages stop rising as oil prices rise, and as other energy prices rise.

Another basic issue: The rate of growth in energy supply is closely tied to the rate of GDP growth

We use energy to make goods and services, so it stands to reason that using more energy would lead to more GDP growth. Economists don’t necessarily agree. They are sometimes of the view that the connection has only to do with “Demand”–in other words, when the economy is growing rapidly it needs more oil and energy products to support it its growth. I discuss Steve Kopits’ talk on this subject in Beginning of the End? Oil Companies Cut Back on Spending.

Something that is perhaps not obvious is the fact that cheap energy supply tends to easier to ramp up than expensive energy supply. Cheap energy supply requires relatively less investment. Goods created using cheap energy supply tend to be inexpensive, making them easier to sell to consumers and more competitive in the world market. I talk about these issues in Oil Limits Reduce GDP Growth; Unwinding QE a Problem.

Another basic issue: The role of debt

Long term debt plays an extremely important role in the economy, because it allows consumers to buy expensive goods like houses and automobiles that they could not otherwise afford, and because it allows businesses to invest in projects before they have saved up sufficient profits from past projects to fund the new projects. It also allows governments to spend more money than they have in tax dollars. All of this purchasing power tends to prop up the price of commodities such as oil and metals, making it feasible to extract them.

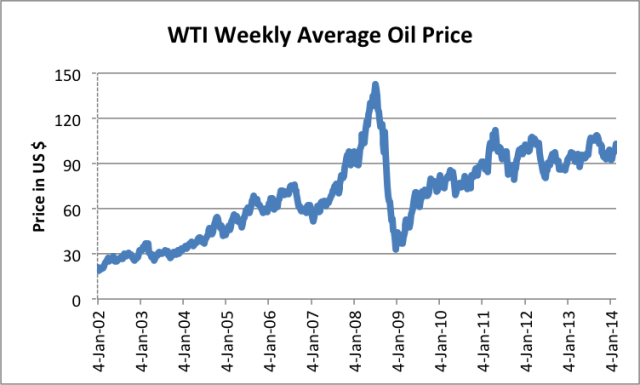

We had a chance to see how important a role debt plays in 2008, during the debt crisis in the second half of the year. During that period, the price of oil dropped from briefly hitting $147 barrel to the low $30s range. Major banks needed to be bailed out, and the insurance company AIG was taken over by the US government because of problems with derivatives.

Figure 1. Average weekly West Texas Intermediate “spot” oil price, based on EIA data.

The big drop in oil price in 2008 was due to a drop in oil demand because of lack of credit availability. I wrote an article in 2008 about the huge impact this decrease in credit availability had on energy prices of all kinds, even uranium.

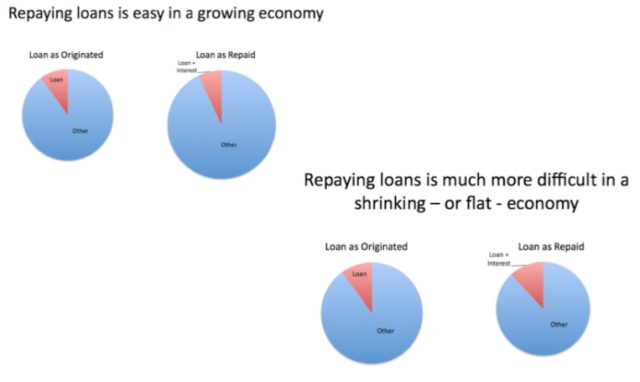

A related concern relates to the fact that “borrowing from the future” — which is what we do with long-term debt, is a great deal more feasible in a growing economy than it is in a shrinking economy. There are a lot more defaults in the latter case, because people keep losing their jobs and businesses keep closing.

Figure 2. Repaying loans is easy in a growing economy, but much more difficult in a shrinking economy.

The concern I have is that as economic growth slows, we will reach a point where long term debt becomes very hard to obtain. The lack of credit in 2008 has not been fully fixed. It was only with the help of Quantitative Easing (QE), which added more demand to the marketplace because of very low interest rates, that oil prices have been able to rise again after the drop in 2008. With the very slow economic growth we have been experiencing recently, it has been necessary to use QE to keep interest rates low enough that people can still afford to buy homes and cars.

If the economy shifts from adding debt to subtracting debt, we are likely to see a huge drop in oil prices, perhaps similar to the drop in oil prices in 2008 to the low $30′s range. If this should happen again, it is not clear that the Federal Reserve would be able to find a way to make the price rise again because is already using a huge amount of stimulus, and thus has fewer options left.

If oil prices drop to a low level and stay down, a large share of oil production will be discontinued. Very little new drilling will be done. Similar effects are likely to happen for other fossil fuels and for mining for metals as well. Such a drop in oil production is likely to be steep–at least as steep as when the Former Soviet Union collapsed. Oil production dropped by about 10% per year, and other energy use dropped rapidly as well. Customers such as the Ukraine and North Korea saw even steeper declines in their oil imports.

Another basic issue: Government funding

Governments are only possible because of the surpluses of an economy. Greater surpluses allow more government employees and more services. Mario Giampietro (2009) is one researcher who writes specifically about this issue. Furthermore, as an economy grows, rising tax revenue makes it is easy to add more programs and services.

As an economy reaches diminishing returns, studies of past economies show that inadequate government funding is one of the major bottlenecks. This occurs because falling resources per capita leads to increasing disparity of wages, with new workers finding it difficult to find good-paying jobs. Governments are called on to provide more programs at precisely the time when their ability to raise sufficient funds to pay for these programs is lacking. A major factor leading to collapse is the inability of governments to collect sufficient taxes from increasingly impoverished citizens.

The Two Way Escalator Problem

As I see it, the economy as it is currently constructed only gives us two options: up and down. The markers of the “up escalator” are

- Cheap energy

- Growing energy supply

- GDP growth

- Wage growth

- Debt growth

- Growing government programs

The markers of the “down escalator” are

- Expensive to produce energy supply

- Energy supply grows slowly

- GDP Growth lags or declines

- Wages lag

- Outstanding debt tends to shrink

- Increasing inability to fund government programs

The two deal-killers with respect to these two escalators are

- Moving from debt supply growth to debt supply shrinkage. This is like moving from Keynesian economics to the opposite. Or from getting a credit card with a large available balance, to having to pay back old credit card debt without adding new debt.

- Increasing inability to fund government programs

The above two reasons are why I expect financial and governmental problems to lead to the end of our current system. Diminishing returns is already leading to higher oil prices, and thus moving us from the up escalator to the down escalator.

I am doubtful we can reestablish very widespread use of long-term debt after a collapse because by that time, the economy will clearly be shrinking. A person often hears people talk about getting rid of the fractional reserve banking system because it requires growth to maintain, but in fact, having such a system has been very helpful in enabling extraction of fossil fuels and allowing the economy to use metals and concrete in quantity. The availability of bonds for financing has been helpful as well.

One essential part of today’s economy is very long supply lines. These allow very complex products to be made, using supplies from all over the world. What we found in the 2008 credit crisis is that many businesses (both large and small) in these supply chains were hit hard by lack of credit availability. I see this issue as being very difficult to solve. If it cannot be solved, we will be faced with making goods locally using smaller companies and very much shorter supply lines. It would be a different system than we have today, and would likely support a smaller world population.

A lot of “peak oilers” would like to think that somehow it is possible to “get off at the mezzanine,” and have a viable economy similar to today’s with a small amount of expensive renewables, plus a continuing supply of fossil fuels. I have a hard time seeing this actually happen. One problem is the likelihood that fossil fuel supply will decline quickly because of low price. Another potential problem is a major cutback in credit availability making transactions difficult; a third issue is governmental problems, as taxes fall short of what is needed to fund programs.

We could in theory get back on the up escalator if we find alternative fuels that meet all of the required specifications–very cheap; available in huge quantity, expanding year by year; can be transformed to a liquid fuel similar to oil; and non-polluting. This seems unlikely right now.

Otherwise, what we do have is all the “stuff” we have today, for as long as it lasts. The economy won’t stop on a dime. We also have the ability to recycle things that we can no longer use, that might be more helpful in another place. Solar panels that people currently own will continue to function for a while (especially off-grid), and the grid will probably continue for a while. We know that many people lived in local economies, before we had fossil fuels, and it is likely to be possible again. We certainly live in interesting times.