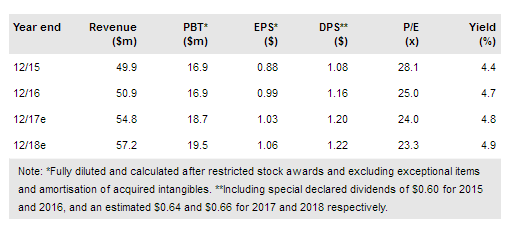

Otc Markets Group's (OTC:OTCM) Q2 results were ahead of our expectations, with a 3% revenue beat translating into operating profits nearly 10% above our estimate: evidence of the potential operational gearing present in the business. We have increased our pre-tax profit estimates by 6% and 8% for this year and next while, on a longer view, the continued increase in the number of states that grant OTCM markets Blue Sky recognition should increase the appeal of these cost-effective trading venues to corporates.

Q217 shows good progress

Second quarter revenue was 9% ahead of Q216, primarily driven by strength in Corporate Services where price increases applied in the OTCQX market were supported by an increase in the number of OTCQB companies and revenue from disclosure, news and other services. Market Data Licensing also contributed increased revenues, but OTC Link ATS saw a 6% reduction as the contraction in the number of broker-dealer participants continued, reflecting pressures on their businesses. Contained operating costs allowed pre-tax profits to increase by 17.5%. Operating cash flow before working capital was up 19% compared with Q216. While the incidence of working capital fluctuations gave rise to an outflow, the cash balance remains above $20m. An unchanged quarterly dividend of $0.14 has been declared.

To read the entire report Please click on the pdf File Below: