Orthofix International N.V. (NASDAQ:OFIX) reported second-quarter 2017 adjusted earnings per share (EPS) from continuing operations of 42 cents, in line with the Zacks Consensus Estimate. Adjusted earnings improved 5% year over year, primarily on strong sales growth at the company’s Biologics and Spine Fixation strategic business units (SBU).

Excluding one-time items, net income in the second quarter came in at $4.7 million or 26 cents per share, showing a remarkable year-over-year improvement from a net loss of $6.3 million or 35 cents.

Sales Details

Orthofix’s second-quarter sales improved 4.7% (5.1% at constant exchange rate or CER) to $108.9 million. The figure also beat the Zacks Consensus Estimate of $103 million by 5.7%.

Sales were primarily driven by better-than-expected performance by all four of the company’s SBUs with significant contributions from Biologics and Spine Fixation.

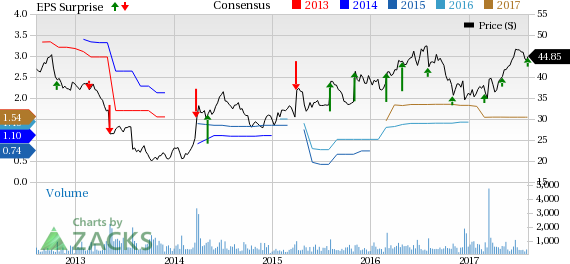

Orthofix International N.V. Price, Consensus and EPS Surprise

SBU Details

For the second quarter, the company reported BioStim sales of $47.1 million, reflecting 5.4% (same at CER) growth from the prior-year quarter. Favorable NASS coverage recommendation, introduction of advanced spinal fusion therapy products and extensive sales force were the major drivers for the BioStim business.

Biologics SBU sales in the quarter totaled $15.7 million, up 9.9% (same at CER) from the prior-year quarter. This was led by strong demand for Trinity Elite due to expanded distributor network, the reacquisition of the national hospital contract along with increased contributions from the national distributor partner.

Extremity Fixationsales were $24.7 million in the reported quarter, showing a decline of 7.7% (6% at CER) from second-quarter 2016. However, after excluding planned subsidiary restructuring and the loss of sales due to the divestiture of a non-core business in 2016 impacts, the trailing 12-month growth rate of this business was 3.5% at CER.

Orthofix reported Spine Fixation SBU sales of $21.4 million, reflecting 17.1% (same at CER) growth over the prior-year quarter. This can be attributed to strong growth in the U.S. and the strategic initiatives adopted

Margins

In the second quarter, gross margin expanded 30 basis points (bps) to 78.7%. Solid top-line growth can be a major factor that might have contributed to the improved gross margin.

Sales and marketing expenses rose 9.6% year over year to $50.5 millionowing to increased sales mix from newly added distributors in Biologics and elevated spending in Extremity Fixation to accelerate sales growth in the U.S. General and Administrative expenses were up 10.1% to $20.4 million led by increased investments to implement the strategic initiatives designed by the company, legal settlements and stock-based compensation. The company also witnessed a 1.3% rise in research and development expenses to $6.8 million. Accordingly, adjusted operating margin in the quarter contracted 250 bps to 7.3% as a result of increased operating expenses.

Cash Position

Orthofix exited the second quarter with cash and cash equivalents of $44.3 million, compared with $41.7 million at the end of the first quarter. Year-to-date net cash provided by operating activities was $9.7 million, compared with $21.4 million in the year-ago period.Excluding capital expenditure of $8.6 million, free cash flow was $1.1 million in the reported quarter. This compares to capital expenditure of $10.4 million leading to free cash flow of $11 million in the year-ago period.

Updated 2017 Guidance

Banking on a solid second-quarter performance,Orthofix has raised its full-year 2017 sales expectations to $422–$425 million from the previous $411–$415 million. The Zacks Consensus Estimate for full-year revenue is pegged at $414.3 million, below the guided range.

Adjusted EPS expectations have also been raised to $1.54–$1.60 from $1.48–$1.58. The Zacks Consensus Estimate for full-year adjusted EPS stands at $1.54, in line with the low end of the company’s projected range.

Our Take

The company exited the second quarter on a mixed note, with sales beating the Zacks Consensus Estimate and earnings meeting the same. Per management, the top line was substantially driven by strength in Biologics and Spine Fixation businesses which is expected to continueon the back of improved performance by sales partners, expanded distributorship network and introduction of products.

Moreover, the company seems to be upbeat on the encouraging response received by the Spinal-Stim and Cervical-Stim bone growth therapy devices launched earlier in 2017. Moreover, the company’s CETRA Anterior Cervical Plate has witnessed strong market adoption, resulting in sales of over $1 million in the first five months since the launch.

Continuing with its slew of product developments and launches, the company recently launched RIVAL, a full line foot and ankle internal fixation system. Also, within its Extremity Fixation space, the company recently launched JuniOrtho, a new brand for orthopedic products, which currently accounts for roughly one-third of Extremity Fixation sales. Also, we believe that the raised full-year 2017 guidance is indicative of enhanced prospects.

On the flip side, currency fluctuations, competitive landscape and macroeconomic headwinds continue to pose challenges for the company. Moreover, higher operating expenses are also a matter of concern for Orthofix. Also, the increased dependence on third –party for final distribution of products exposes the company to increased risks.

Zacks Rank & Key Picks

Orthofix has a Zacks Rank #3 (Hold). A few better-ranked medical stocks are Edwards Lifesciences Corporation (NYSE:EW) , INSYS Therapeutics, Inc. (NASDAQ:INSY) and Align Technology, Inc. (NASDAQ:ALGN) . Notably, Edwards Lifesciences, INSYS Therapeutics and Align Technology sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

INSYS Therapeutics has a long-term expected earnings growth rate of 20%. The stock posted a stellar four-quarter average earnings surprise of 60.7%.

Align Technology has an expected long-term adjusted earnings growth of almost 26.6%. The stock has added roughly 25.9% over the last three months.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. The stock has gained around 5.9% over the last three months.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look. See the pot trades we're targeting>>

Orthofix International N.V. (OFIX): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

Insys Therapeutics, Inc. (INSY): Free Stock Analysis Report

Align Technology, Inc. (ALGN): Free Stock Analysis Report

Original post