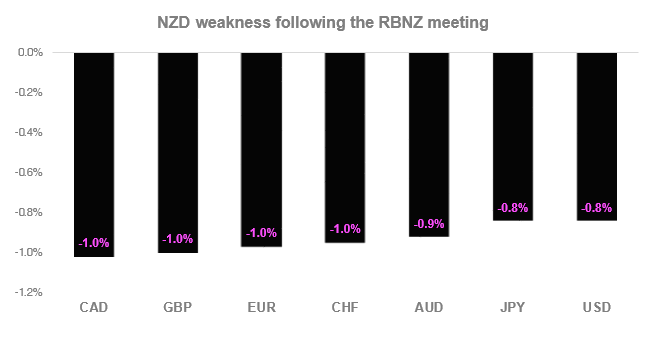

Markets were prepared for RBNZ to hold, but the volatile and decisively bearish reaction for NZD suggests traders weren’t positioned for the dovish undertone. We’ll take look at key takeaways, reaction and levels.

Key takeaways:

- GDP and inflation forecasts were lowered

- RBNZ expect to keep rates at 1.75% for a “considerable time”

- The next move could be “either up or down”

The New Zealand dollar wasted no time in broadly selling off and breaking key levels. Furthermore, as the new Governor Adrian Orr described the NZD “well behaved” (after selling off for several weeks) it suggests he is more than happy to see it fall further.

Although some of the moves are at risk of over-extension to the downside for NZD, their trends remain intact and may provide opportunities further out. With that in mind, we’ll cover two NZD crosses of interest.

We can see how NZD/CAD broke its corrective channel in line with bearish momentum ahead of the meeting, and that momentum has only increased since. With no immediate signs of a bottom or threat to the bearish trend, we aim to stick with it. However, it is fast approaching a key structural level at 0.8848 which itself is reason to suspect profit taking may not be far away. Furthermore, RSI is heavily oversold and price action is quite stretched beneath its lower Keltner band to warn of over-extension. Still, as the trend remains overwhelmingly bearish, we’ll await a more suitable, low volatility entrance before entering short.

We highlighted the importance of 0.6953 support as a break beneath it exposed the November and December lows. Well, the meeting certainly made light work of this key level and it’s encouraging to see an hourly close confirmation beneath it. Again, it looks overstretched to the downside (on multiple timeframes) with an oversold RSI, and has already found support around the lower channel (which has already been breached). But with an important hurdle out of the way, we can look for signs of compression and aim to short in line with the dominant trend if, or when the opportunity arises.