Infrastructure and trading strategy driving growth

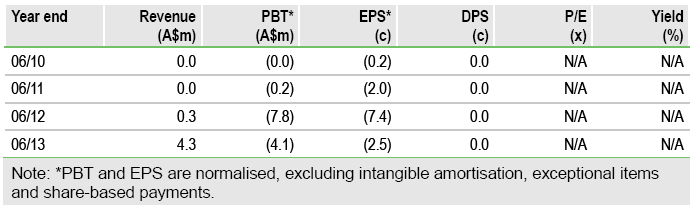

Orpheus Energy (OEG.AX) is consolidating Indonesian port allocations and facilitating coal exports from fragmented coal producers, some of which do not have export licences. This ‘logistics trading’ model will generate additional cash flow without raising new capital and is in contrast to many coal companies that are struggling to achieve production or growth.

Capital light infrastructure and trading model

OEG is evolving from predominately a coal mining company to a coal infrastructure and trading company. This has been achieved by securing coal infrastructure agreements that provide agreed coal export capacity for its own produced coal (OEG attributable share 51%) and the loading of other producers’ coal (OEG attributable share 100%). The company makes a trading margin on each tonne of coal shipped. The change is in line with the company’s stated strategy. It represents a ‘capital-light’ model with greater potential for scale. Two infrastructure agreements have so far been announced and more are possible. By employing this model, OEG has been able to avoid shareholder dilution. The agreements overcome constraints to sales due to the limited availability of barge loading slots and enable OEG to expand port capacity through efficiencies and investment. The agreements should increase coal exports from less than 50,000 tonnes per month to >240,000 tonnes per month, equivalent to approximately 3.0Mtpa. By 2015, annual exports are expected to increase to 4.5Mtpa.

OEG secures 100% interest in two agreements

Both agreements are in South Kalimantan. The most significant agreement is with SKJM Port, which will continue to be managed by the current port owner while OEG has responsibilty for allocating loading slots. This agreement requires a payment comprising a fee for the lease and a modest level of capital for both upgrade and expansion work. This will be funded off balance sheet by a local infrastructure investor. The upgrade will lift capacity to 2.5Mtpa then to 4.0Mtpa after the expansion. The second agreement has been executed with Abidin 1 Port and secures just under 0.5Mtpa capacity for OEG’s exclusive use.

Mining investment to be deferred

OEG anticipates an average net trading margin of around US$2 per tonne on coal handled through the ports. It believes this is the best way of providing profit growth with the present balance sheet. The expansion of its higher-margin but more capital-intensive mining operations has been deferred for the time being.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Orpheus Energy: Secures 100% Interest In Two Agreements

Published 10/14/2013, 06:20 AM

Updated 07/09/2023, 06:31 AM

Orpheus Energy: Secures 100% Interest In Two Agreements

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.