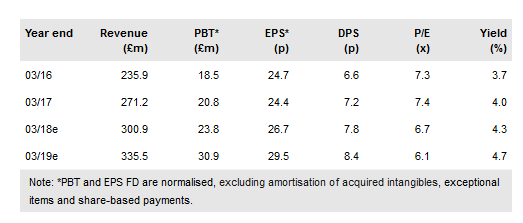

In Norcros' (LON:NXR) first half, the company delivered improved profitability, made significant organic business investment and completed an earnings enhancing UK acquisition. Merlyn is a highly complementary business and a logical addition to the business portfolio. Taken together, we raised our current year EPS by c 4% and by c 7% and c 9% in the following two years, with dividends nudged up also. The share price has performed well on this newsflow but Norcros still represents good value, in our view.

Earnings progress and investment

H118 results confirmed an earlier update flagging good revenue progress in both the UK and South Africa without much help from their respective markets, where consumer challenges have been evident. Operating profit was ahead of the prior year with a material step forward in South Africa partly offset by P&L investment in the UK, which held back its reported EBIT. It should be noted that both divisions have continued to invest in business development which has, to some extent, had an impact on short-term profitability but should benefit future periods. The company generated positive underlying cash flow and declared an 8.3% uplift to interim DPS.

To read the entire report Please click on the pdf File Below: