Investing.com’s stocks of the week

Zubsolv gains; US moves to increase treatment

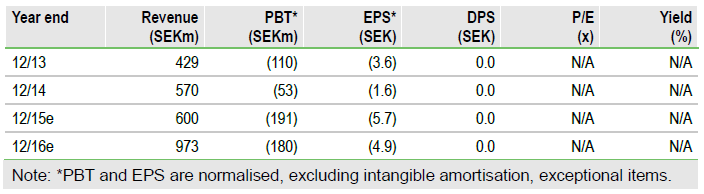

A positive Q315 with Zubsolv sales broadly in line with expectations, coupled with a number of positive and potentially significant developments, continues to support our thesis that Orexo's (ST:ORX) share price is overly discounting Zubsolv’s potential. The US government has announced plans to expand access to opioid dependence treatment, which could substantially increase the US market opportunity, reinforcing our current peak sales forecasts. This is in addition to key market share gains, induction label approval and two new PBM agreements. Our valuation is updated to SEK5.8bn, with the decrease owing to Abstral generics and the impact of the CVS (N:CVS) loss to 2016 Zubsolv sales.

Zubsolv: Market share gains all round

Zubsolv made market share gains in Q315, growing in the main commercial market and regaining share in the highly profitable cash segment. This helped to boost the gross:net sales ratio, also aided by a one-off revision related to assumed rebate levels. The commercial segment remains the main focus for Orexo and Zubsolv continues to increase its share, which will be key for driving future growth.

First US government moves to increase access

In what could potentially be significant changes to the US opioid dependence market, the US government has announced plans to increase access to medication-assisted treatment (MAT), such as with Zubsolv, with goals to double the number of physicians authorised to prescribe buprenorphine. This is currently limited to 30,000 physicians, with around 6,000 active in treating; all have a 100-patient cap. If realised, these goals could substantially expand the current market.

Intensive discussions for Zubsolv ex-US and OX51

Orexo remains in active discussions for both Zubsolv outside of the US and for pain product OX51. Orexo reiterated its focus to find the right partner committed to maximising each opportunity.

To Read the Entire Report Please Click on the pdf File Below