Zubsolv makes key gains in Q3

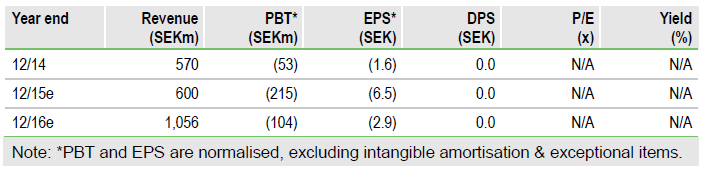

We believe Orexo's (ST:ORX) Q315 financial results are solid, with revenues just below but profits ahead of the trends implied by our 2015 forecasts. There have been a number of positive developments during Q315 that should help drive mid- to long-term Zubsolv sales. These include a steadily growing market share, an expanded Zubsolv label, new PBM agreements to offset the CVS loss, and important initial steps by the US government to increase access to treatment, which could substantially increase the current US opioid dependence market. These factors reinforce our view that Orexo’s share price is overly discounting Zubsolv’s potential.

Zubsolv Q315 net revenues were SEK110.8m, +21.6% compared to Q215 and +62% y-o-y. Zubsolv’s market share has steadily increased, ending Q315 at 6.4% (from 6% at the start). Patient demand grew 6.2% compared to Q215, with sales also aided by stocking, currency and an improved gross:net sales ratio. Zubsolv continues to make gains in the commercial segment (market share now 9.3%); this is the largest and one of the more profitable segments, hence traction here is key.

To Read the Entire Report Please Click on the pdf File Below