2014: Focused on further delivery

Zubsolv has captured 1.9% market share (by volume) in the first 18 weeks since launch. Orexo AB, (ORX) is focused on maximising Zubsolv’s commercial potential through further improvement in market access and lifecycle management. Securing reimbursement on par with competition (particularly at larger commercial payers) should drive near-term sales growth, and new clinical data could expand Zubsolv’s current label and take market share from Reckitt Benckiser’s Suboxone film (>80% market share). Management expects to obtain 25-30% market share within three years of launch. We value Orexo at SEK7.9bn (US$1.2bn).

Zubsolv: Steady market share gains

Prescribing data shows steady growth in volumes and value: more physicians are prescribing Zubsolv, and writing longer prescriptions. The impact of Tier II status at CVS Caremark and Medimpact, and at other health plans, coupled to a 25% increase in the field force should start to be evident in Q1. Zubsolv is now available in over 13,000 pharmacies; promisingly, all wholesalers have reordered.

Opioid dependence: A growing market

The US buprenorphine/naloxone market was worth $1.9m at end-2013; continued double-digit is growth expected. The inclusion of addiction therapy as an essential benefit under the Affordable Care Act provides an obligation for insurer coverage. Physician and patient education should improve diagnosis/treatment rates and adherence. Earlier diagnosis could expand the number of treating physicians; access to treatment along with affordability is a significant bottleneck.

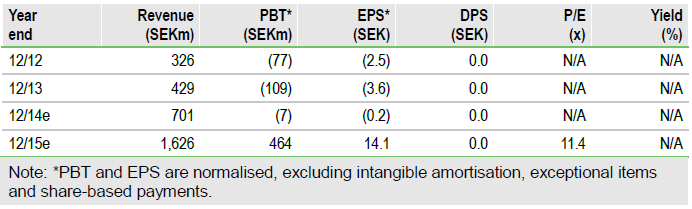

Financials: Investing in the foundations for growth

An EBIT loss of SEK139.7m reflected investment in infrastructure for Zubsolv launch and in R&D. Given high initial rebating and conservative revenue recognition tying revenues to prescriptions, wholesalers’ stocking of SEK70m (gross sales value) translated into recognition of SEK7.3m of net Zubsolv sales. Introduction of a high-scale manufacturing proces should improve COGS from late-2014/early2015.

Valuation: SEK7.9bn ($1.2bn or $37/share)

Recent market growth has increased our DCF-based valuation to SEK7.9bn or SEK239/share (previously SEK6.7bn, SEK203/share), assuming a 25% peak market share and average 35% rebate. At this early stage in the launch, uncertainty over the profile of Zubsolv’s trajectory remains.

To Read the Entire Report Please Click on the pdf File Below